To prepare

your Finance and Operations to report VAT return for a VAT group, make sure

that your business processes and the system setup are in-line with the

following terms:

- Tax information from all the subsidiaries

is registered in the same system – Finance and Operation.

- All the tax transactions are

correctly reflected in the system in accordance with the rules and principles

of the United Kingdom.

- Settlement periods for all the legal

entities involved to the VAT group are defined identically and in full

accordance with the period intervals defined in HMRC online account.

- VAT settlement (“Settle and post”

procedure) is done in each subsidiary legal entity.

- “VAT 100” report is correctly

generated for preview in each subsidiary legal entity.

- One legal entity is setup for

interoperation with HMRC according to the documentation (Prepare Finance and Operations for integration

with MTD for VAT (United Kingdom)) and user can request VAT obligations from this legal entity for the

VAT group.

This

article provides information:

- How to setup additionally

Electronic reporting configurations to collect data from several legal

entities for VAT return reporting of the VAT group.

- How to setup Electronic

messages functionality additionally to the general process of MTD for VAT

feature setup to collect data from several legal

entities for VAT return reporting of a VAT group.

- How to use Electronic

message page to collect information for VAT return reporting from several legal

entities.

Import and setup Electronic

reporting configurations to collect data from several legal entities for VAT

return reporting of the VAT group

To prepare

electronic reporting configurations for generation of the common VAT return of

a VAT group based on tax transitions posted in several legal entities, import

and use the following or later versions of the Electronic reporting

configurations:

|

GER configuration name, version

|

Description

|

|

Tax declaration

model.version.32

|

Generic model for different

tax declarations

|

|

Tax declaration model

mapping.version.32.38

|

Generic model mapping for VAT

declarations

|

|

MTD VAT returns exporting

JSON (UK).version.32.28

|

VAT return in JSON format for

submission to MTD HMRC

|

|

MTD VAT returns exporting

EXCEL (UK).version.32.28.8

|

VAT 100 report - declaration

in Excel format

|

Starting from

these versions, Tax declaration model, model mapping and both formats for the

UK VAT return support cross-company tax transactions data sources and can be

used to aggregate data from several legal entities. These configurations can

still be used to report VAT return from just one legal entity.Important

note: Finance and Operations of version 10.0.7 or later supports these versions

of the electronic reporting configurations. For the version 7.3 of Finance and

Operations the KB # 4513052 must be

installed and the latest version of the Electronic reporting update.

To use the

formats for reporting of VAT return of a groups of several legal entities, you

must set up Application specific parameters for each of the legal entities

included into the group:

- Open Electronic reporting module and

select Tax declaration model > MTD VAT returns exporting JSON (UK) format in the configurations tree.

- Select in the right top corner the

Legal entity from VAT group tax transactions from which must be included into

the VAT return of the group.

- Click Configurations > Application

specific parameters > Setup on the Action pane, select the last version

of the format on the left part of the Application specific parameter page and

define conditions on the Conditions fast tab. Learn more how you can

define conditions in the Set

up application-specific parameters part of the documentation. Change stat

to Completed, save and close the Application specific parameters

page.

- Change the legal entity again (as on

the step 2) and repeat the step 3 as many times as much legal entities are

included in the VAT group in your system.

- Repeat all the steps above for MTD VAT returns exporting EXCEL (UK) format.

Setup Electronic messages

functionality additionally to the general process of MTD for VAT feature setup

for VAT group reporting

Starting

from 10.0.7 version, Microsoft Dynamics 365 for Finance and

Operations allows user to prepare a VAT return report collecting

information from several legal entities into the one Electronic reporting

format. For this purpose, system must collect Sales tax payment

transactions posted in different legal entities under the same Electronic

message. Following steps must be done additionally to all the steps of the

general process of MTD for VAT feature setup:

1. Activate “Cross-company queries

for the populate records actions” feature in Feature management.

Open Workspaces > Feature management find “Feature

management” and click “Enable now” button on the right bottom of the

page.

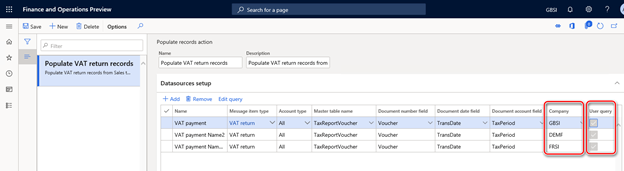

2. When “Cross-company queries for

the populate records actions” feature is activated in the Feature

management, open Modules > Tax > Setup > Electronic

messages > Populate records actions page. A new field “Company”

will be available on the Datasources setup grid. For the already

existing record created during the general process of MTD for VAT feature setup

and current legal entity identifier is defined in the Company field. It is

assumed that Settlement period for the current legal entity is already setup during

the general MTD for VAT feature setup.

3. Add as much lines to the “Datasources

setup” as more legal entities are to be included in the VAT group reporting:

one record for each legal entity and define fields’ values:

|

Field name

|

Value

|

|

Name

|

Enter a text value

which would help you understand where this record from. For example: “VAT

payment of Subsidiary 1”

|

|

Message item type

|

Select “VAT

return” – the only available value for all the records.

|

|

Account type

|

All

|

|

Master table name

|

“TaxReportVoucher”

– the same for all the records.

|

|

Document number

field

|

“Voucher” –

the same for all the records.

|

|

Document date

field

|

“TransDate” –

the same for all the records.

|

|

Document account

field

|

“TaxPeriod” –

the same for all the records.

|

|

Company

|

Select the ID for

the subsidiary legal entity.

|

|

User query

|

Yes (marked automatically when you

define criteria by “Edit query” button)

|

Click “Edit

query” for each of the new records and specify related “Settlement

period” for the legal entity defined as Company in the selected

line.

As a

result, you will have as much lines in the “Datasources setup” grid as

more legal entities must be included into reporting of the VAT group with Settlement

periods defined for each of the Company:

In Finance

and Operation version 7.3 you must skip step 1 “Activate “Cross-company

queries for the populate records actions” feature in Feature management”,

as the new “Company” field on Populate records action page becomes

available after the hotfix installation.

The changes

in the setup of populate records action described above are enough to collect

Sales tax payment transactions from different legal entities in one electronic

message and further generate one common VAT return report in JSON (for

submission to HMRC) or Excel (for preview) file.

Use Electronic messages

page to collect information for VAT return reporting from several legal

entities

Setup one

legal entity to interoperate with HMRC according to the general guidance (Prepare

Finance and Operations for integration with MTD for VAT (United Kingdom)),

provide addition setup to populate records action as it is described in the

section above and retrieve

VAT obligations for your VAT group and move further to Collect

data for VAT return:

- Open Tax > Inquires and

reports > Electronic messages > Electronic messages

page and select “UK MTD VAT returns” processing for production use or “UK MTD

VAT TEST” processing for testing purposes.

- Select an electronic message in “New

VAT return” status on the Messages fast tab which was automatically created

as a result of retrieving of VAT obligations from HMRC.

- When you have activated “Cross-company

queries for the populate records actions” feature in Feature management,

you will see Company column on the Message items fast tab of the Electronic

messages page. Click “Collect data” button on the Messages

fast tab and Sales tax payment transactions from all the legal entities defined

as datasources on populate records action will be populated as message items on

the Message items fast tab. When you click on “Original document”

button for a message item populated from a legal entity differ from the current

one, you will be redirected to the appropriate company.

- Work further with the Electronic

message as according to the general process to generate VAT return for preview

or for submission to HMRC and submit it when it is ready (Generate

a VAT return in Excel format for preview, Generate

a VAT return in JSON format, Submit

VAT returns to HMRC).