ICMS-ST tax assessment

Before to proceed with the generation of statement for each state, you

need to create a fiscal booking period for the month , the ICMS-ST tax

assessment for the related state and then calculate balances if applicable in

the state.

Open

Fiscal books >Common >Tax assessment >ICMS-ST and

click Presumed taxes balance.The form includes fields that are needed for the reporting purposes:

Item code, product description, inventory unit measure, quantities, ICMS and

ICMS ST taxes and base amounts per inventory unit and their totals.

In

the Presumed taxes balance form, click Calculate inventory balances.

System will calculate the initial Opening balance and the Closing

balance and show the figures per Item number.Opening balance calculation function works as

following:

- Validates whether the presumed taxes balance for previous period exist.

If no such balances observed, then starts the calculation; otherwise the

procedure considers the figures from the previous period.

- Selects all items in on-hand inventory which have any transactions

before the period.

- Calculates quantity for every selected item on the first day of the

period.

- Finds last purchase for every item with the ICMS-ST tax transaction.

- Using the tax amounts from the last purchase and converting the purchase

unit to the inventory one, calculates ICMS and ICMS-ST amount for the on-hand

inventory quantity.

Closing balance calculation. Only applicable for

SP state

- Deletes old presumed taxes balances for the period except the records

which are used for the next period (these amounts will be updated; all other

amounts will be recalculated).

- Selects all items in on-hand inventory which have any transactions in

the period.

- For every item search for the presumed taxes balance in the previous

periods to get quantity for the opening balance, otherwise it would be zero.

- Selects all incoming fiscal documents in the period, summarizes

ICMS/ICMS-ST tax amounts and summarizes items quantities.

- Calculates average amount per unit by summarizing the totals of ICMS/ICMS-ST

amounts of all incoming documents and dividing them by the summarized quantity in

these documents.

- Selects all outgoing fiscal documents and summarizes their quantities.

Calculates ICMS/ICMS-ST tax amounts using the average amount which was

calculated in step 5.

- Calculates closing balance amounts and quantities using the values from the

previous periods and the sums of incoming and outgoing documents from current

period. These sums were calculated in step 4 and 6, respectively.

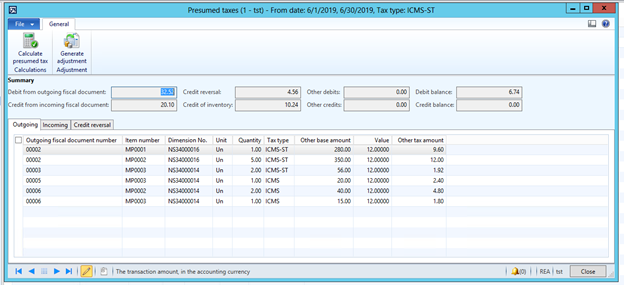

Presumed tax

calculation

Once the Balances are calculated (for the first time), open the Presumed

taxes form and click Calculate presumed tax.

The form includes fields that are needed for the reporting purposes and

each tab includes the related fiscal documents that are applicable for

compensation and restitution in accordance with the criteria’s established by

state law.

- Outgoing tab: Fiscal document number, item code, inventory unit measure,

quantities, ICMS and ICMS ST tax rates, ICMS and ICMS ST tax and base amounts

and calculated presumed taxes.

- Incoming tab: Fiscal document number and date, item code, inventory unit

measure, quantities, and ICMS and ICMS ST tax and base amounts.

- Credit reversal. Only applicable for RS state. Outgoing Fiscal documents to

non-final consumer and taxation code = 60 and/or to final consumer with ICMS =

exempt or non-taxable taxation code <> 60

Presumed tax calculation - Average algorithm

works a following:

- Selects all lines of all outgoing fiscal documents in the current

period.

- For every item from these lines selects all lines of all incoming fiscal

documents with the same item code in the current period. And then calculates

average ICMS/ICMS-ST tax amount.

- In case of no incoming document in the period, then the corresponding

record in the presumed taxes balances is taken into consideration.

Note for SP. For Sales

complementary fiscal documents and Purchase order returns the average values

are not calculated, the values from the original fiscal documents are

considered only.

Generate adjustments

Use this button for RS

state to generate the related tax adjustment to be reported in SPED Fiscal.

Depending on type of

company business (Retail or Non retail), Dynamics AX will generate the related adjustments:

- Debit for outgoing

fiscal documents

- Credit for incoming

fiscal documents

- Credit from Inventory

position (opening balance). This tax adjustment will be created once and split

in 3 installments.

- Credit Reversal.

- Compensation and

restitution (reversal)

- Compensation in record

E220

- Restitution in record

E111

Note: Once you pressed Generate Adjustment button, there is no

way to go back to the initial state. You must reverse manually the adjustment

transaction created during the execution of this option to report record E220

or E111. The other adjustments related

to debit, credit, credit for inventory and credit

reversal are only created for SPED fiscal purposes. You will not able to

see these transactions since are saved in a temporary table.

Statement generation

SP state

Navigate to Fiscal books>Common>Booking period and

on the Tax statements tab click CAT 4218 SP. This

statement is also available in ICMS-ST tax assessment for SP state.

- File name – enter the path where the file should be saved and the name of the

text file.

- Layout version – select the version.

- File type – select one of the available options for the type of the file:

- Regular

- Specific intimation

- Substitute

The generated text file should be validated first by using tax authority

application and once the file was successfully approved you will be able to

send tax authorities.

RS state

Navigate to Fiscal books>Common>Booking period and

on the Tax statements tab click SPED fiscal. This

statement is also available in ICMS-ST tax assessment for RS state.

Introduce the regular parameters that are usually introduced to generate

the statement SPED Fiscal. In order to generate the records 1900 and related

you must reproduce the following steps:

- Create and Sync the related booking period

- Sync Inventory if applicable the criteria to take the credit from

opening balance of inventory.

- Create or Update the ICMS-ST tax assessment for RS state

- Calculate Presumed tax balances (if applicable)

- Calculate Presumed tax

- Generate adjustments. Click on Generate Adjustment button under Presumed

tax form

- Complete the remainder activities or steps related to ICMS-ST tax

assessment

- Then generate SPED Fiscal statement as usual.

SC state

Navigate to Fiscal books>Common>Booking period and

on the Tax statements tab click SPED DRCST. This statement

is also available in ICMS-ST tax assessment for SC state

- File name – enter the path where the file should be saved and the name of the

text file.

- File type – select one of the available options for the type of the file:

This file is submitted by using webservices and require certificate.

Once the return message is received with the result of government validation,

the response is saved in the same location where the file was generated.