“Date of VAT register”

activating

The Date

of VAT register field is shared globally and can be enabled in legal entities

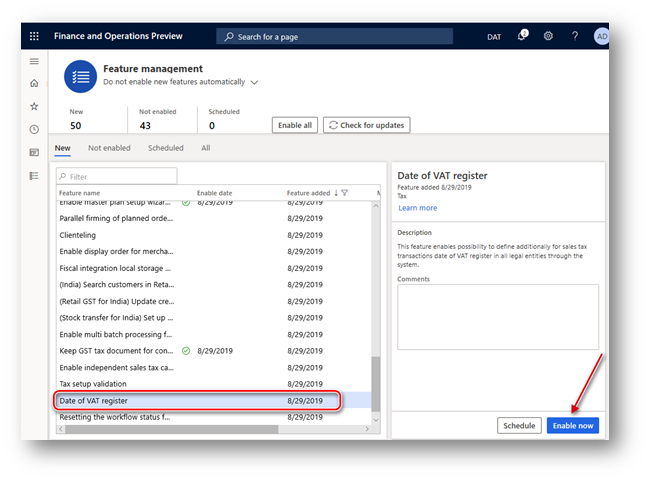

with primary address in any country. To switch on this functionality in Finance and Operations version 10.0.6 and later “Date

of VAT register” feature must be enabled in the Feature management

workspace:

To

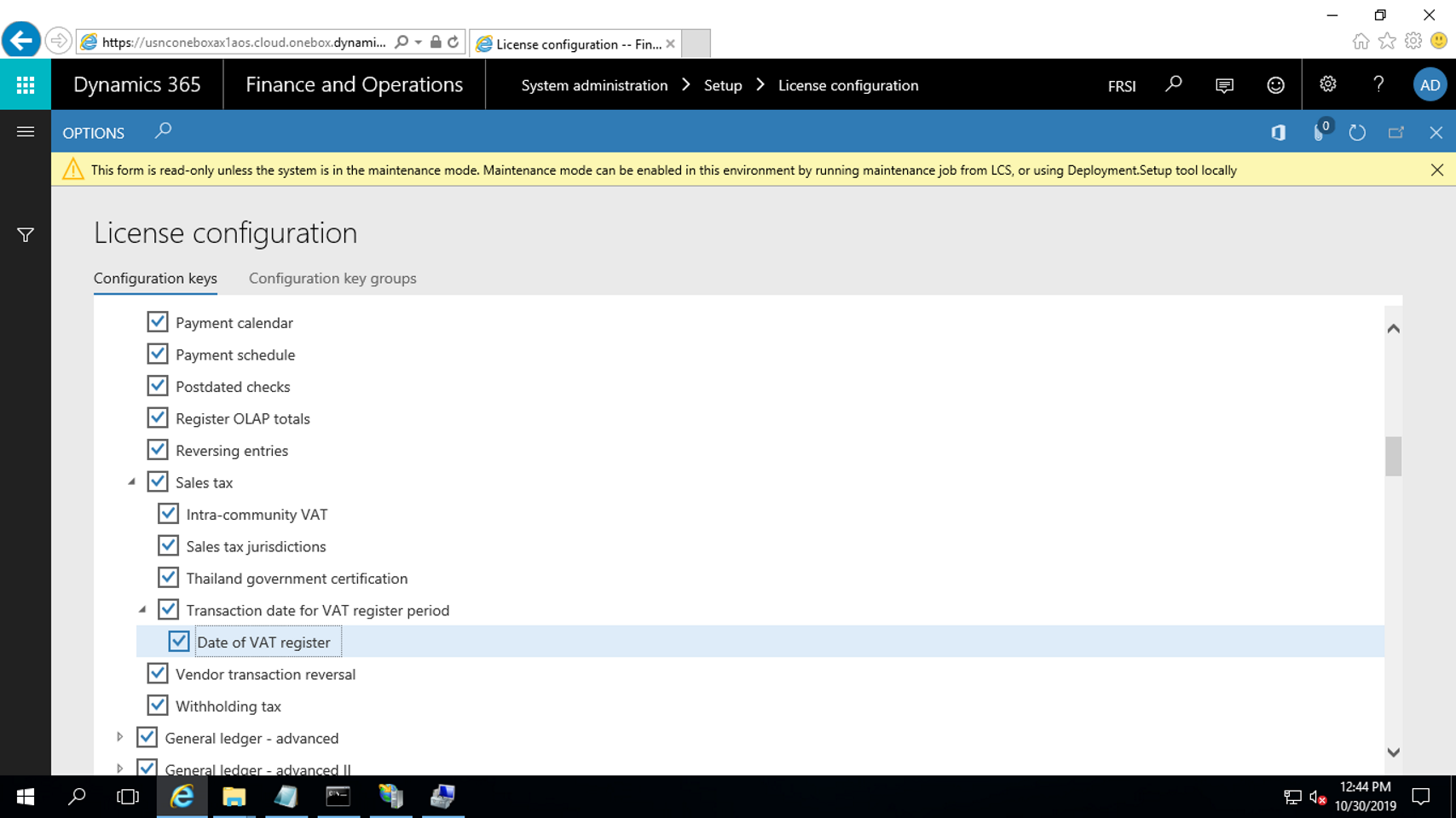

switch on “Date of VAT register” functionality in Finance and Operations version 7.3:

- Open System

Configuration > License configuration page

- Enable maintenance mode

- iisreset

- Enable General Ledger >

Sales tax > Transaction date for VAT register period > Date of VAT

register configuration key

- Disable maintenance mode

When “Date

of VAT register” feature is enabled in the Feature management workspace or as a configuration key (for the version 7.3), user

can define additionally for sales tax transactions date of tax point by using “Date

of VAT register” field in all legal entities through the system.

“Date of

VAT register” field appears on more than 20 pages. These pages include

journals, sales orders, purchase orders, free-text invoices, vendor invoice

journals, and project invoices. When you update or post the documents, all

taxes are posted by using the corresponding date of the VAT register, and the

date is included on pages such as the customer and vendor invoice journals

pages.

Note, that system

doesn’t allow to post an invoice with value of “Date of VAT register” field

in a closed interval of sales tax settlement period.

“Date of

VAT register” field appears also in the following reports:

- Tax >

Inquiries and reports > Sales tax reports > Specification

- Tax >

Inquiries and reports > Sales tax reports > Sales tax transactions

- Tax >

Inquiries and reports > Sales tax reports > Sales tax transactions –

details

- Tax >

Inquiries and reports > Sales tax reports > Sales tax specification by

ledger transaction

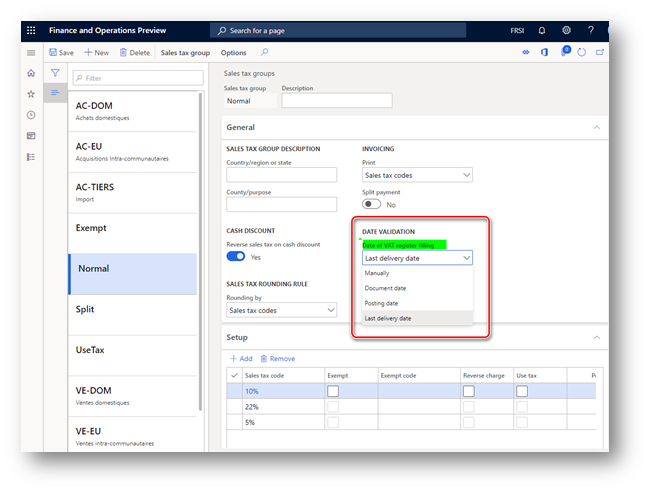

Auto-filling of “Date of

VAT register” value

“Date of VAT register” feature enables possibility

to select a method of auto-filling of “Date of VAT register” field via the Date of VAT register filling parameter on

the Sales tax groups page:

This option fills in automatically “Date of VAT

register” field during invoice creation. The following methods are available to select:

- Manually – no value

will be defined for Date of VAT register field. User can manually define

the value before invoice posting.

- Document date – value of

Date of VAT register field will be defined automatically on document

date change.

- Posting date - value of

Date of VAT register field will be defined automatically on posting date

change.

- Last delivery date - the

date of last packing slip (for sales order) or product receipt (for purchase

order) will be populated as Date of VAT register of the invoice.

“Date of VAT register”

filling after invoice posting

If for some

reason an invoice is posted with empty “Date of VAT register” field, it

is still possible to fill it in. To do so, open Tax > Periodic

tasks > VAT register transactions page. This page represents sales

tax transactions with empty “Date of VAT register” field. You may select

one record for update or a set of records by using a Filter function. To define

the value for Date of VAT register field of the select record, click “Date

of VAT register” button on the Action pane of the page and specify the value

in the “Date of VAT register” field of the dialog. Updated record will

be automatically filtered out from the list of records on the VAT register

transactions page.

System

doesn’t allow to update “Date of VAT register” field with a value in a

closed interval of sales tax settlement period.

“Date of VAT register” impact on VAT settlement

and reporting

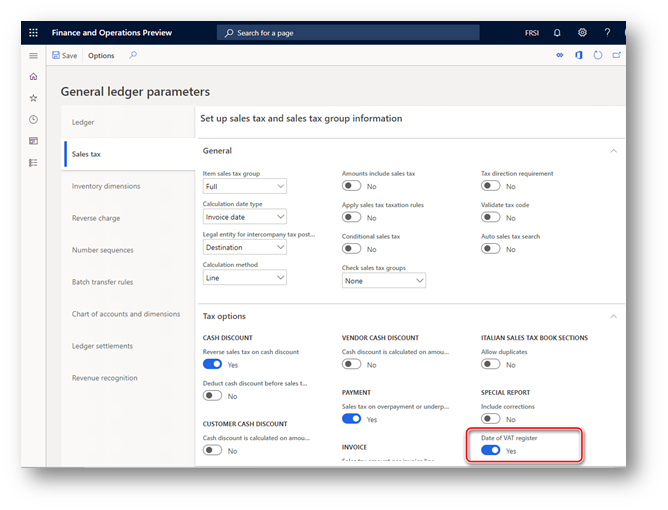

When “Date of VAT register”

feature is enabled in the Feature management workspace, user in legal

entity with primary address in Italy will be able to activate “Date

of VAT register” parameter on General ledger parameters page:

When this parameter is switched

on, “Settle and post sales tax” process and “Italian sales tax

payment report” will consider sales tax transactions by “Date of VAT

register” instead of date of transaction posting.

Note, that system will not

allow:

- to switch On “Date of VAT register”

parameter on General ledger parameters page if there are tax

transactions posted in open interval of sales tax

settlement period with value of “Date of VAT register” field in a closed

interval of sales tax settlement period.

- to switch Off “Date of VAT register”

parameter on General ledger parameters page if there are tax

transactions with value of “Date of VAT register”

field in a closed interval of sales tax settlement period but posted

in open interval of sales tax settlement period.

- to switch Off “Date of VAT

register” feature in Feature management workspace if there is at

least one legal entity where “Date of VAT register” parameter on

General ledger parameters page is switched on.

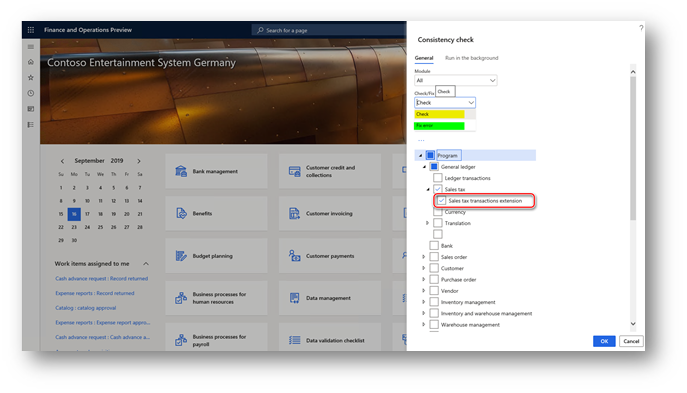

“Sales tax transactions

extension” consistency check

“Date of VAT register” field is physically stored in a TaxTrans_W

table which an extension of TaxTrans table. When a company switches on "Date of VAT register” parameter on General ledger parameters page, data source queries on

some pages in the system starts working differently, joining the TaxTrans_W

table. It is possible that user will not be able to see tax transactions posted

in the past period. It is because there are no corresponding transactions in TaxTrans_W

table because it was not used in the past.

To avoid this issue, we recommend running “Sales tax transactions

extension” consistency check. Open System administration > Periodical

tasks > Database > Consistency check page and mark Program

> General ledger > Sales tax > Sales tax transactions

extension check box (you don’t need to mark the parent checkboxes if you want

to run only Sales tax transactions extension check):

Run “Sales tax transactions extension” consistency check with:

- “Check” option to find out if there are missing transactions in TaxTrans_W table in your system. As a result, system

will inform you about how many transactions in TaxTrans table miss corresponding

records in TaxTrans_W table.

- “Fix” option if you want to compensate missing records in TaxTrans_W

table. As a result, system will insert corresponding records to the TaxTrans_W

table and Posted sales tax transaction in the past periods will be seen again everywhere

in the system.

Make sure that you have chosen the right date in "From date" on the dialogue . Leave "From date" field blank if you want to recover all the tax transactions in the system.

“Sales tax transactions extension” consistency check is available

when “Date of VAT register” feature

is enabled in Feature management workspace.

"Sales tax transactions extension" consistency check is available in build version starting from 10.0.234.21 for 10.0.6 version of the application and any version starting from 10.0.7.

Changes in the Italian sales

tax payment report

You may run “Italian sales

tax payment report” by using the following menu items:

- Tax > Declarations

> Sales tax > Sales tax (Italy)

- Tax > Declarations

> Sales tax > Report sales tax for settlement period

- Tax > Inquires

and reports > Sales tax payments, Sales tax (Italy) button

- Tax > Inquires

and reports > Sales tax payments, Print report button (when

Italian report layout is defined for the Sales tax authority specified for

the Sales tax settlement period of the selected Sales tax payment line)

“Date of VAT register” parameter on General ledger parameters

page doesn’t impact on list of invoices represented on Sales tax book section(s)

page(s), all the invoices posted in the related Sales tax book sections during

the selected period will be included into the report. Nevertheless, resulting amounts

of VAT will be calculated depending on “Date of VAT register” parameter on

General ledger parameters page:

- when “Date of VAT register” parameter

on General ledger parameters page is switched On – by “Date of VAT

register” of tax transactions in the period.

- when “Date of VAT register” parameter

on General ledger parameters page is switched Off – by posting date of

tax transactions in the period.

When “Date of VAT register” parameter on General ledger

parameters page is switched On, “Italian sales tax payment report”

will additionally provide the following information:

1. Pages

of sales tax books sections: new “Date of VAT point (Date of VAT register)” (in

Italian: “Momento di effettuazione dell’operazione”) column – represents the

value of “Date of VAT register” of tax transaction.

2. Totals

by each sales tax book section is represented in three groups:

- Operations in the actual period with

competence date in the actual period

- Operations in the actual period with

competence date in the previous period

- Operations in the next period with

competence date in the actual period

3. Totals

by sales and purchase books are represented in three lines:

- Total operations in the actual period with

competence date in the actual period

- Total operations in the actual period with

competence date in the previous period

- Total operations in the next period with

competence date in the actual period

4. Summary

section which represent total VAT amounts by sales tax books sections grouped

by sales tax book sections, is represented separately in three parts:

- Operations in the actual period with

competence date in the actual period

- Operations in the actual period with

competence date in the previous period

- Operations in the next period with

competence date in the actual period

5. Totals section on summary section which represents total VAT amounts by sales tax books

sections grouped by sales tax book sections, is represented separately in three

lines:

- Total operations in the actual period with

competence date in the actual period

- Total operations in the actual period with

competence date in the previous period

- Total operations in the next period with

competence date in the actual period

Additionally, “Total

calculated considering competence date” amount is provided in a separate line of totals

on summary section which represents total VAT amounts by sales tax books

sections grouped by sales tax book sections.