The hotfix provides support of changes in VAT invoices report (SAF invoices

or JPK_FA) introduced by the version 2 which must be valid from July 1, 2019.

To prepare your AX 2012 R3 system to report “JPK_FA” report of version “2”

(from the beginning of July 2019) the following steps must be done:

- Install the hotfix

package (link to download is in the “Hotfix information” section of this

article), which contains new XSLT file (AifOutboundPortReportSAFVATInvoice_PL.xslt).

- Open AOT > Resources,

select AifOutboundPrtReportSAFVATInvoice2019_PL, right-click on it and

select Open.

3. In the opened

Preview form click on Export button, select folder to save the “AifOutboundPortReportSAFVATInvoice_PL”

file and click Save.

4. Open the

saved “AifOutboundPortReportSAFVATInvoice_PL” file in the specified folder and

find the row #25 to replace temporary values with the Sales tax code(s)

used in your Legal entity to post transactions on Reverse change (which

must be reports as “oo”):

row #25 <xsl:variable name="ReverseChargeTaxCodes"

select="'TaxCode1;TaxCode2;TaxCode3'"/>

Note! Follow the syntaxis applied in the example: replace

only names of the Sales tax codes.

5. In the “AifOutboundPortReportSAFVATInvoice_PL”

file find also the row #26 to replace temporary values with the Sales

tax code(s) used in your Legal entity to post transactions on Reverse change

(which must be reported as “np”):

row #26 <xsl:variable name="NonTaxableTaxCodes"

select="'TaxCode4;TaxCode5;TaxCode6'"/>

Note! Follow the syntaxis applied in the example: replace

only names of the Sales tax codes.

6. Save the changes in the AifOutboundPortReportSAFVATInvoice_PL”

file.

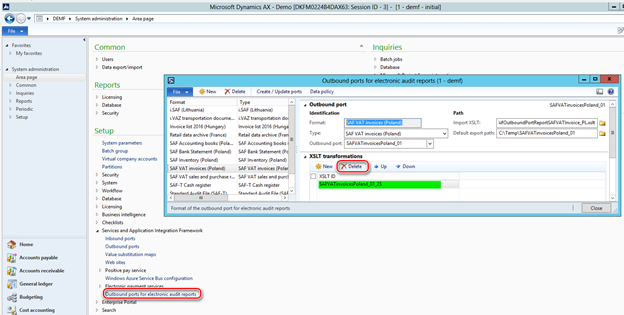

7. Open System administration > Setup > Services

and Application Integration Framework > Outbound ports for electronic

audit reports, select the “SAF VAT invoices (Poland)” format (if it exists) and Delete related XSLT transformation :

8. Click folder icon of the “Import

XSLT” field on the “Outbound port” fast-tab and select the

exported and updated before “AifOutboundPortReportSAFVATInvoice_PL.xslt” file (p.3-6 of this guidance).

9. Click on “Create / Update ports”

button on the Action pane, check the XSLT transformation was updated.

10. If “SAF VAT invoices (Poland)” format was not set up

before you need to click on “Create / Update ports” button on the Action pane to populate the

list of default ports, define the path the “AifOutboundPortReportSAFVATInvoice_PL.xslt”

file (p.8 of this guidance),

set "Default export path" to the folder you expect where the

reports to be saved, click "Create / Update ports" to import the

XSLT into Dynamics AX with the default ID. The "XSLT ID" field is set

to reference the XSL transformation. As a result, the outbound AIF port is created

and initialized with a list of needed services.

In

particular, the algorithm of P_12 field’s value which besides the tax

rate must represent three text values (“oo”,

"np", “zw”) is based

on supposition that companies in Poland define and use a specific Sales tax

code(s) for reverse charge and is the following:

|

Value

|

Description (pl)

|

Description (en-us)

|

How AX 2012 R3 will distinguish

|

|

oo

|

odwrotne obciążenie

|

Reverse charge

|

In XSLT: Create a configurable list of Sales tax codes (raw #25) to

define Sales tax codes specifically used for Reverse charge

|

|

np

|

Niepodlegające opodatkowaniu-transakcje

dostawy towarów oraz świadczenia usług poza terytorium kraju

|

Non-taxable supplies of goods and services outside the country

|

In XSLT: Create a configurable list of Sales tax codes (raw #26) to define

Sales tax codes transactions on which with _exempt_ will be

reported as “np”. These Sales tax codes should not be included into the list for Reverse chanrge.

|

|

zw

|

zwolnione z opodatkowania

|

Exempt from taxation

|

Other _exempt_ tax transactions will be reported as “zw” (Sales tax codes, included into the Sales tax groupe with "Exempt" but not included into the configurable list in the raw #26 and #25).

|