Define Cadastral cost, Cadastral number, Room

cadastral number for Realty

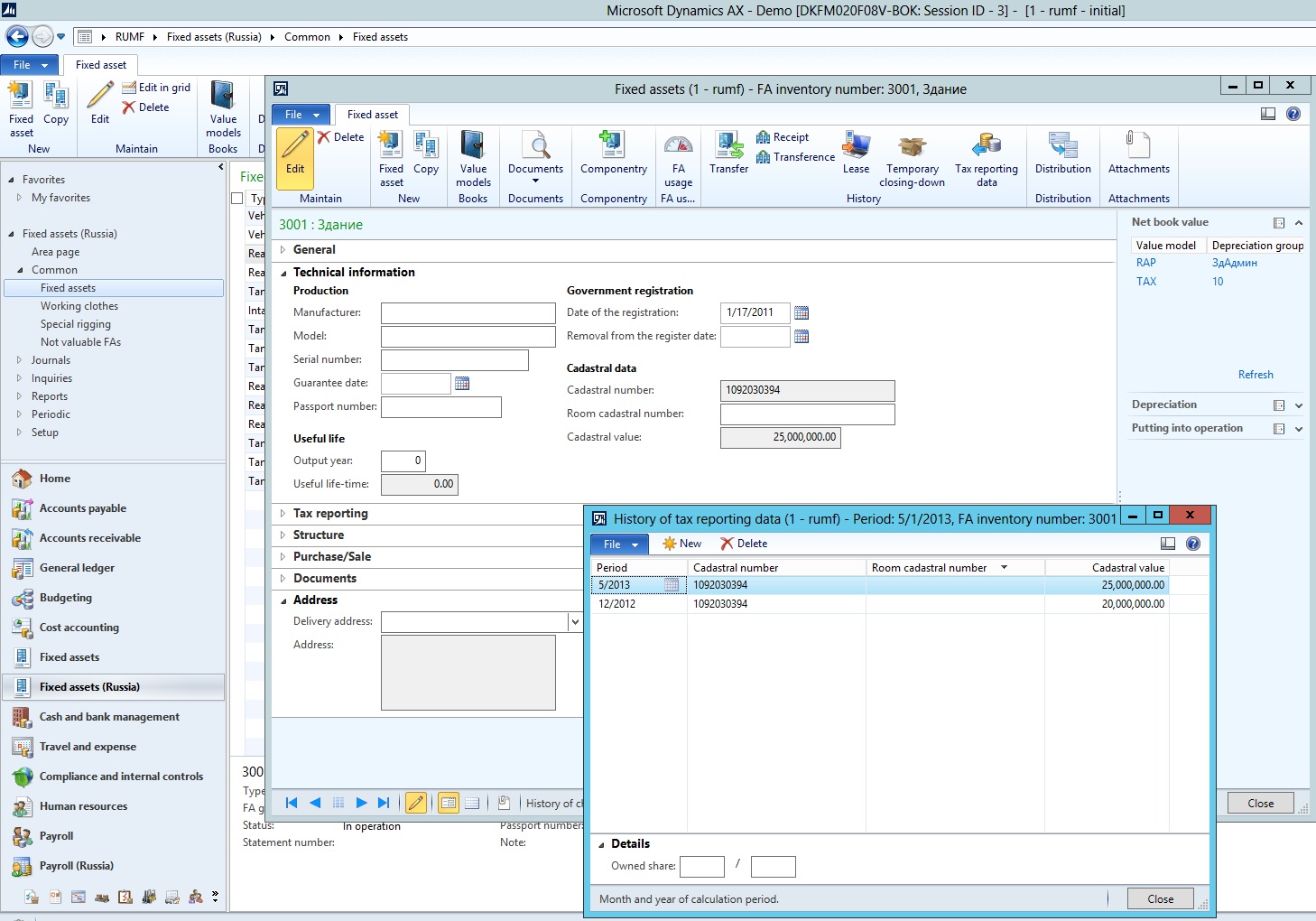

In the fixed asset card, on the tab Technical

information, you can define Cadastral number, Room cadastral number and Cadastral value of the Realty.

On the tab Tax reporting, you can define Owned share.

When the cadastral value of the Realty taxed at

cadastral cost, is changed because of the change in quantitative or qualitative

characteristics, you can define the new values in the form History of tax

reporting data. Click Tax reporting data button in the Action pane

of fixed asset card.

Define the Period, from which the change occurs

(period format is Month-Year), define new value of Cadastral number, Room

cadastral number, Cadastral

value and Owned share.

You may define only those values which are changed and

not define values which are not changed. Values which are defined in this form,

are not editable in the fixed asset card.

Note. When you define a Cadastral cost change for the first

time, you should create two lines: first with old values for the historical

period and a new one with new values.

Calculate tax registers and generate declaration in

the standard way.