Setup

When a

company is signed up for the MTD service for VAT in HMRC, to get Dynamics AX

2012 R3 ready to interoperate with HMRC web service for retrieving VAT obligations

and submission of VAT returns the following steps should be done in the Dynamics

AX 2012 R3:

·

Set

up Web service parameters

·

Set

up Web application for production use or testing interoperation with HMRC's sandbox

· Obtain Authorization

code

·

Get Access token and activate application

Set up Web service parameters

Open General ledger > Setup > External services > Web

service parameters form.

Use this

form to define following parameters of the Web service:

|

Field

|

Description

|

Value example

|

|

Sandbox base URL

|

When

a sandbox web application is created on HMRC side, define its base URL https

address.

|

|

|

Production base URL

|

When

your HMRC account is setup on production application, define its base URL

https address.

|

|

|

Authorization URL path

|

Set

up authorization URL path used for HMRC web application.

|

/oauth/authorize

|

|

Token URL path

|

Set

up token URL path used for HMRC web application.

|

/oauth/token |

Set up Web application for testing

Open General ledger > Setup > External services > Web applications

form.

Use this

form to define following parameters of a Web application:

|

Field

|

Description

|

|

Application name

|

Type

a name of the application. It can be the name of the application in HMRC or

any other you choose to identify the application in AX.

|

|

Description

|

Fill

in a description of the application.

|

|

Application type

|

Select

Sandbox, if you are going to use

this application for testing purposes connecting to an HMRC’s sandbox.

Depending

on this type system will use either Sandbox

base URL address of the Web-service.

|

|

Settlement period

|

Select

AX Sales tax settlement period for

which VAT returns must be submitted using this Web application.

Only

one Sales tax settlement period

can be selected for each Web

application.

|

|

Client ID

|

Type

Client ID of the Web application. This parameter is

related to a set of HMRC application parameters and can be found in Manage credentials section of an

application in HMRC portal.

|

|

Client secret

|

Type

Client secret of the Web application. This parameter is

related to a set of HMRC application parameters and can be found in Manage credentials section of an

application in HMRC portal.

|

|

Redirect URL

|

Type

Redirect URL of the Web application. This parameter is

related to a set of HMRC application parameters and can be found in Manage redirect URIs section of an

application in HMRC portal.

|

|

Access token will expire in

|

This

is a read-only field which shows when the last received access token will

expire. This field is updated automatically when an access token is received

from HMRC.

|

|

Scope

|

This

is a read-only field which shows a scope which was requested from HMRC for

the application during initial authorization for the application.

User

must fill in this value manually on HMRC authorization.

The

following values are allowed by HMRC:

-

read:vat

-

write:vat

-

read:vat write:vat

It

is recommended to use “read:vat

write:vat” as the same application must be used for both GET and POST

https requests to the web service.

|

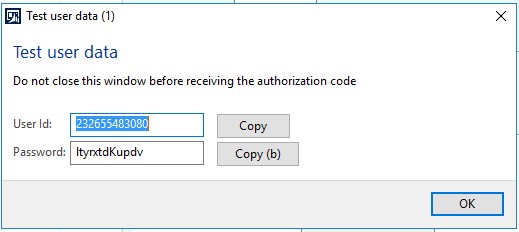

Create Test user

This function

is available for applications of Sandbox type only. Click on Get test user button on the Action pane

of Web applications form to create a

test user which can be used to access HMRC’s sandbox environment. Type Server

token of your testing application in the dialog and click OK. Server token is a

parameter of an HMRC’s application. It can be found in Manage credentials section of your testing HMRC’s application on

HMRC portal. When you click OK button of the dialog, a request for test user is

sent to HMRC and a response is received. You will be able to see the response

in Test user

data form in AX. Don’t close this form until you get an Authorization

code as information in it will be requested by HMRC to sign in on getting HMRC

authorization. Following three parameters from this response will be further

used:

-

User ID - you will copy and paste it during sing in on

HMRC portal for Authorization code retrieving.

-

Password - you will copy and paste during sing in on

HMRC portal for Authorization code retrieving.

-

VRN – will be saved automatically in AX. This VAT

registration number will be used for testing interoperation with HMRC.

To be able

to create a test user, Create test user

API must be activated for your HMRC’s application. To do so, open Manage API subscriptions section for

your testing application in HMRC portal and activate Create test user API in Test

Support APIs.

Obtain Authorization code

Authorization

code is needed to request an Access token. Authorization code received from

HMRC is valid only 10 minutes within which an Access token can be requested. If

an Access token is not requested and Authorization code has expired, a new

Authorization code must be requested.

Click HMRC authorization button on the Action

pane of Web applications form to get

an Authorization code from HMRC. It is recommended to type “read:vat write:vat” in Scope field of the dialog so the

application could be allowed for both GET and POST https requests. Click OK to

send your Authorization code request to HMRC. You will be redirected to HMRC

sign in web page. Click Continue

button and use you company’s User ID

and Password granted during HMRC

online account registration for production web application authorization. For Sandbox application, copy

and paste User ID and Password from the Test user data form in AX which you received from HMRC on Test user creation stage:

![]()

Copy Authorization code created by HMRC and

go back to AX to initialize getting of Access token during 10 minutes.

Get Access token and activate application

Initialize

getting of Access token during 10 minutes from the moment an Authorization code was generated by

HMRC.

Click Get access token button on the Action

pane of Web applications form to

request an Access token form HMRC. Past value copied on the previous “Obtain Authorization code” step to the Authorization code field of the

dialog and click OK. Access token request will be sent to HMRC and an Access

token will be automatically saved in AX from the HMRC’s response. It is not

allowed to review the token from user interface of AX. You can observe validity

period of Access token in Access token

will expire in field. Each Access token is valid during 4 hours from the

moment when it was created by HMRC. To receive a new one, you don’t need to

renew an Authorization code. For this purpose, you need to Refresh access

token.

When Access token is granted, mark Active field of the application to use

this application for further interoperation with HMRC. Only one Web application can be active for each Sales tax settlement period. System

will not allow to activate a Web application before an Access token is received

from HMRC.

Refreshing access token

Each Access

token is valid during 4 hours from the moment when it was created by HMRC.

Click on Refresh access token button on the

Action pane of Web applications form

to manually initiate refreshing of an access token. Refresh Access token

request will be sent to HMRC and a new Access token will be automatically saved

in AX from the HMRC’s response.

It is not needed to refresh token manually each

4 hours or before you start to interoperate with HMRC. During interoperation

with HMRC this refreshing Access token procedure will be initialized

automatically and refreshing of Access token will be hidden from user.

Set up Web

application for production use

When a company is ready to interoperate with MTD for

VAT in live, it must sign up to MTD and create a HMRC online account (Government Gateway account) unless

one already exist. The company will then need to link it to the Microsoft

Dynamics AX 2012 R3 application by selecting Microsoft Dynamics AX 2012 R3

as the software. The company will then obtain user credentials (User ID and

password) that are linked to its VAT registration number:

· User

ID – The name that is used to access HMRC while an authorization code is

being requested.

· Password

– The password that is used to access HMRC while an authorization code is being

requested

After the company has obtained user credentials an

application of Production type can be setup on AX side. Application of

production type is uniquely identified by Client ID and Client secret

and are provided by Microsoft (unless the company is creating their own

solution for any Dynamics AX version). The following steps must be done on AX

side to setup the application of Production type:

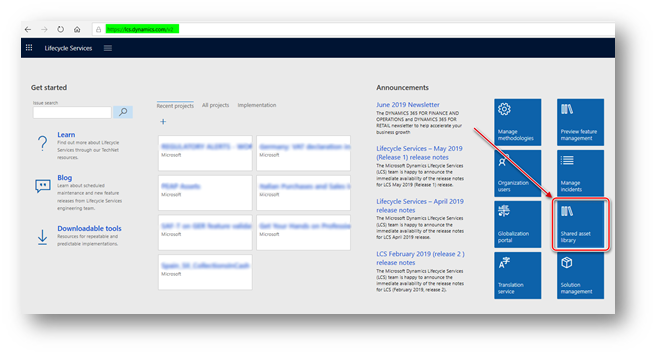

1. Open LCS portal, go to Shared asset library:

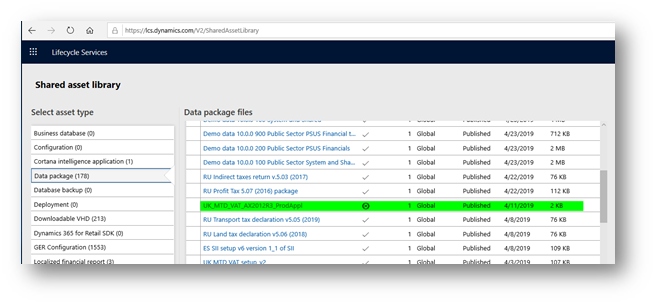

2. Select Data package section and find latest (by

Modified date) version of UK_MTD_VAT_AX2012R3_ProdApll.zip file,

download this file on your computer:

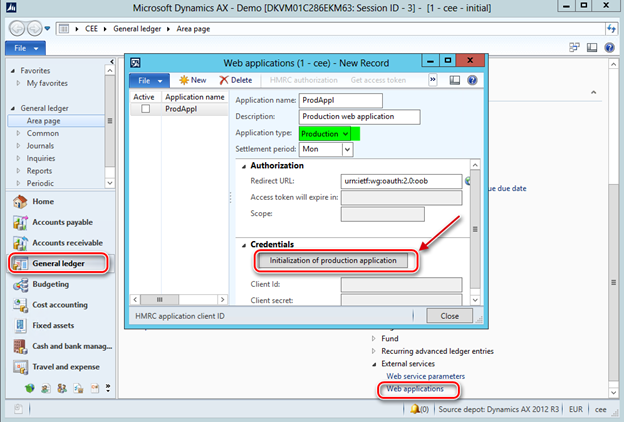

3. Open in Dynamics AX 2012 R3 General ledger >

Setup > External services > Web applications form

and create a new record. Fill in fields:

|

Field

|

Description

|

|

Application name

|

Type a name of the application. It can be any name you

choose to identify the application in AX.

|

|

Description

|

Fill in a description of the application.

|

|

Application type

|

Select “Production” when you create an

application for production usage which you are going to use for real-life

submission of VAT returns to HMRC.

|

|

Settlement period

|

Select AX Sales tax settlement period for

which VAT returns must be submitted using this Web application.

Only one Sales tax settlement period can be

selected for each Web application.

|

|

Redirect URL

|

Type “urn:ietf:wg:oauth:2.0:oob” in this

field.

|

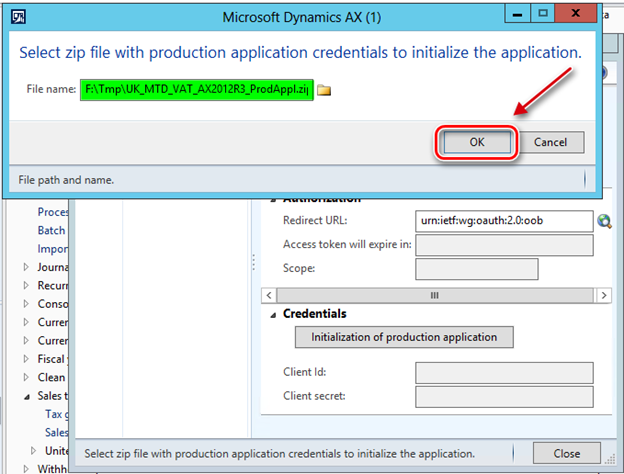

4. Click “Initialization of production application”

button on the Credentials fast tab:

5. Select previously downloaded from LCS portal UK_MTD_VAT_AX2012R3_ProdApll.zip

file. Don’t unzip the file. Click OK button and production application

credentials will be populated to the system:

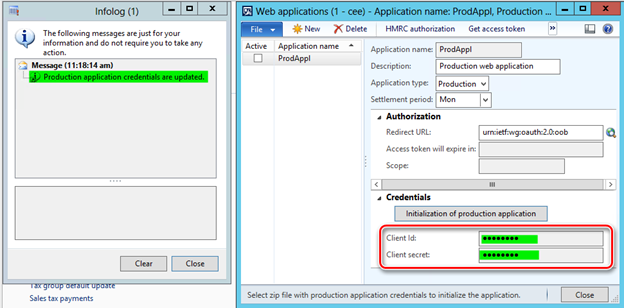

6. Client ID and Client

secret of production application are populated in your system in encrypted

format:

When web application of production type is setup in AX,

authorize it to get ready to interoperate with HMRC:

1. Open General ledger > Setup > External

services > Web applications form and select web application of

production type for which Client ID and Client secret are

imported.

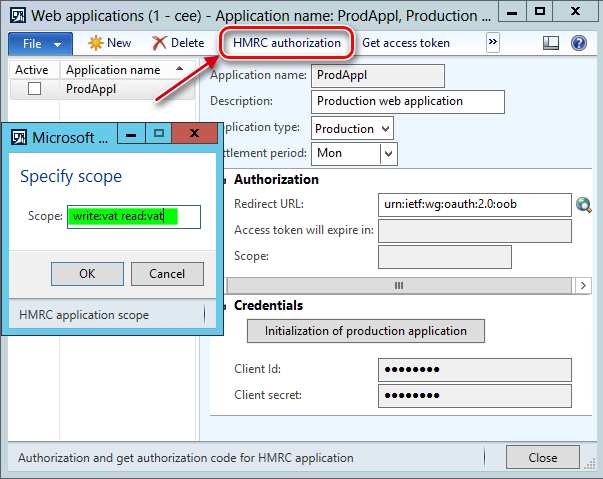

2. Click HMRC authorization button on the Action

pane to obtain Authorization code from HMRC for the selected web application, specify

“write:vat read:vat” in Scope field and click OK:

3. A web browser will be opened, and you will be directed

on HMRC portal for authorization. Authorize on the page with User ID and

Password, which were obtained for your company via online account on

HMRC. As a result, an Authorization code will be generated and shown on

the browser page.

4. Copy Authorization code and open General

ledger > Setup > External services > Web

applications form in AX again. Authorization code is valid only 10

minutes within which an Access token can be requested. If an Access token

is not requested and Authorization code has expired, a new Authorization code

must be requested.

5. Click Get access token button in General

ledger > Setup > External services > Web

applications form in AX and paste Authorization code copied on the

previous step. Each Access token is valid during 4 hours from the moment

when it was created by HMRC. To receive a new one, you don’t need to renew an

Authorization code. For this purpose, you need to Refresh the access token.

6. As a result, an Access token will be granted by

HMRC and saved in your system. You will see “Access token expire in” and

“Scope” fields are filled in for the selected web application of

production type.

Use Refresh access token button on the Action

pane of General ledger > Setup > External services

> Web applications form in AX to manually initiate an access token

refreshing.

7. Activate the web application by setting Active check-box for the related web application:

When you have set Active a web application of production type, your system is ready to interoperate with HMRC for VAT MTD in live.

Retrieving VAT obligations

from HMRC

When Web service parameters are setup and Web application is created and

activated, system is ready to interoperate with HMRC.

(!) Important note: VAT registration number (VRN) of the legal entity must be defined in Organization

Administration > Legal Entities, on the Foreign trade and

logistics tab, in the "VAT exempt number export” field. This field is

used as a VRN source for VAT 100 report and MTD-feature, respectively.

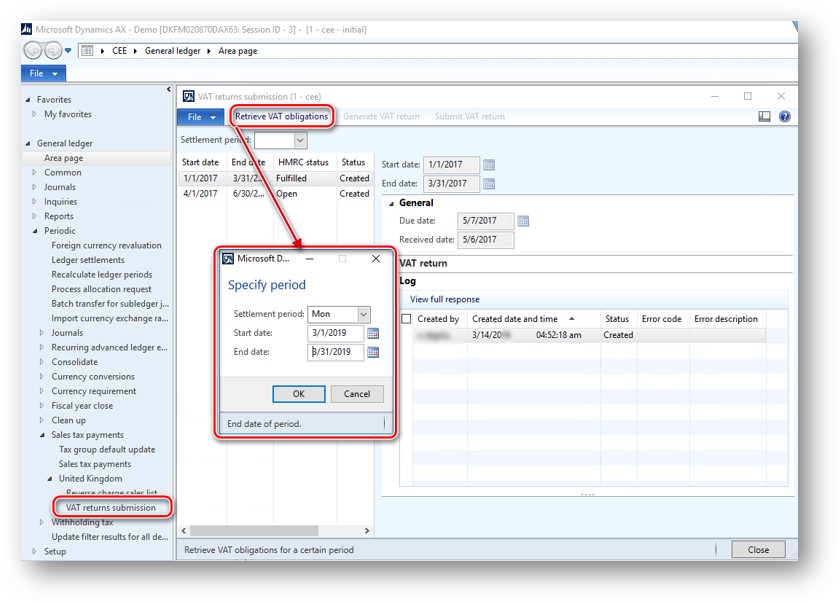

Open General ledger > Periodic > Sales tax payments > United

Kingdom > VAT returns submission form.

This form presents information about VAT obligations and returns and serves for

interoperation with HMRC web service.

|

Field

|

Description

|

|

Start date

|

Start

date of an accounting period in HMRC.

|

|

End date

|

End

date of an accounting period in HMRC.

|

|

HMRC status

|

Reporting

status of an accounting period in HMRC. It can be either Open or Fulfilled.

|

|

Period key

|

VAT

obligation related to an accounting period in HMRC is identified in HMRC by

value of Period key field. This field is not shown on the form and must be hidden from the user interface to complete the requirement of the HMRC.

|

|

Settlement period

|

AX

Sales tax settlement period set up for the Web application. VAT return will

be calculated basing on Sales tax transactions posted in this Sales tax

settlement period.

|

|

Status

|

AX

internal Status of VAT obligation.

It can be either:

-

Created

-

Generated

-

Submitted

-

Error.

|

|

Due date

|

The

due date for this obligation period. This field is updated from HMRC only.

|

|

Received date

|

The

obligation received date. This field is updated from HMRC only when VAT

obligation is fulfilled.

|

|

VAT return

|

This

field shows generated VAT return in JSON format. User can review calculated

amounts before their submission to HMRC.

|

|

Sales tax payment version

|

This field shows value of Sales tax payment

version parameter with which VAT return was generated.

|

|

Processing date

|

The

date when the VAT return was processed in the HMRC. This field is updated

from HMRC only when VAT obligation is fulfilled.

|

|

Payment indication

|

Is “DD”

if the netVatDue value is a debit and HMRC holds a Direct Debit Instruction

for the client. Is “BANK” if the netVatDue value is a credit and HMRC holds

the client’s bank data. Otherwise not present. This field is updated from

HMRC only when VAT obligation is fulfilled.

|

|

Form bundle number

|

Unique

number that represents the form bundle. The HMRC system stores VAT Return

data in forms, which are held in a unique form bundle. This field is updated

from HMRC only when VAT obligation is fulfilled.

|

You may

review all the actions done with a VAT obligation on the Log fast tab.

VAT

obligations must be received first from the HMRC. Click Retrieve VAT obligations button on the Action pane.

|

Field

|

Description

|

|

Settlement period

|

Select

AX Sales tax settlement period in this field. This must be a Sales tax

settlement period for which you want to get your VAT obligations and further

submit VAT return. This parameter defines the Web application in the system to be used to interoperate with HMRC.

|

|

Start date

|

Select

the date starting from which you want to retrieve VAT obligations from HMRC.

|

|

End date

|

Select

the end date of a period for which you want to retrieve VAT obligations from

HMRC.

|

An active Web application set up for the Sales

tax settlement period will be used for interoperation with HMRC. If this

application is of “Sandbox” type,

you will see an additional dialog with Test

scenario field. Define one of testing scenario supported by HMRC (see

Manage API subscriptions > APIs > VAT > Endpoints > Retrieve VAT

obligations > Test data section of HMRC related to your testing application,

to find all the Gov-Test-Scenario). For example, you can type “QUARTERLY_NONE_MET”

in this field to simulates the scenario where the client has quarterly

obligations and none are fulfilled. You may leave this field blank to initiate

“Default” testing scenario which simulates the scenario where the client has

quarterly obligations and one is fulfilled. Click OK button. Your request to

HMRC will be sent and response received. According to the response, new records

in VAT returns submission form will

be created or existing updated.

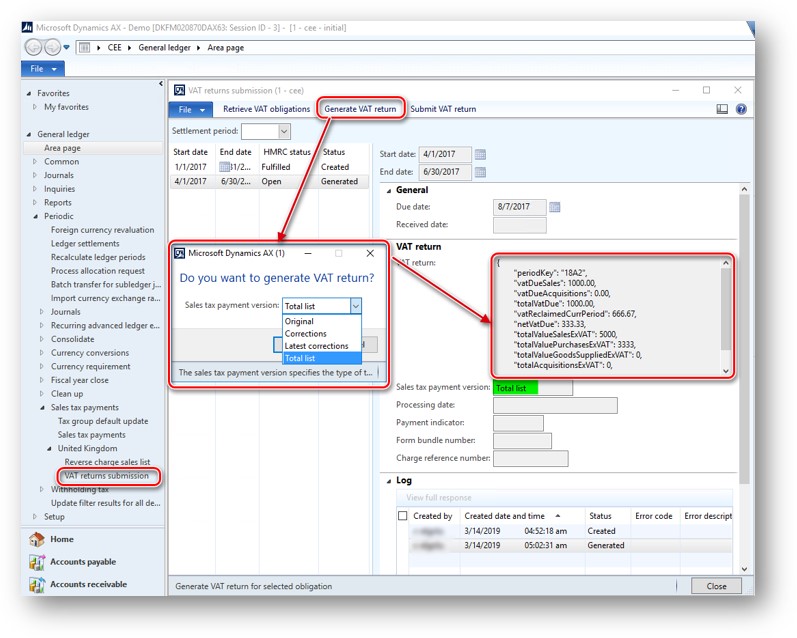

Generate VAT return in

JSON

MTD for VAT

accepts VAT returns in JSON format only. To generate VAT return in JSON format select

a record on VAT returns submission

form related to the obligation period you are going to report. Click on Generate VAT return button on the

Action pane of VAT returns submission

form. Select in Sales tax payment

version field of the dialog one of the values similarly to you select on Sales tax payments report generation:

-

Original

-

Corrections

-

Latest

corrections

-

Total

list.

Click OK.

VAT return in JSON format will be generated and available for review in VAT return field.

You may

regenerate VAT return several times until you submit it to HMRC.

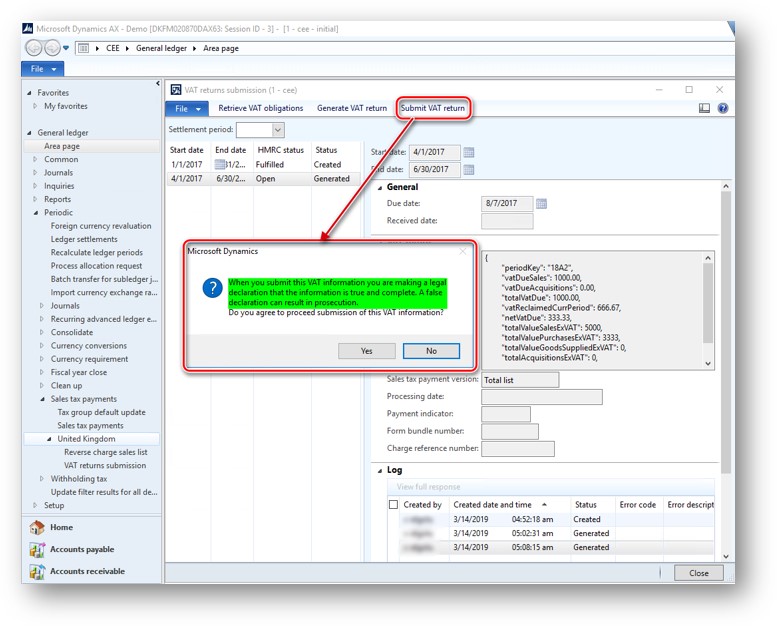

Submitting VAT returns to

HMRC

When VAT

return in JSON format is generated and ready to be submitted to HMRC, click on Submit VAT return button on Action pane

on the VAT returns submission form.

VAT return can be submitted to HMRC just once for each obligation period. Make

sure you want to submit VAT return before click YES in AX warning box. Warning

box includes declaration that the user by clicking “Yes” button confirms that

the information which is going to be submitted to HMRC is true and complete.

Accepting this declaration by “Yes” button user is responsible for the submitted

information. If you are not sure that VAT return is ready to be submitted,

click NO. When you click YES, generated VAT return in JSON format related to

the selected record in VAT returns

submission form will be submitted to HMRC. If VAT return is submitted

successfully to HMRC its status will be updated respectively to Submitted. HMRC status, Received date field in AX will be updated if you retrieve VAT

obligations for a period including the reported one. In case of any error

during submission of VAT return to HMRC, Status

will be updated to Error.

You may

review all the actions done with a VAT obligation on Log fast tab of the VAT

returns submission form. When a response is received from HMRC you may

review its full text by View full

response button. In case of error, Error

code field will show a code of error from response and Error description field will show description of error from the

response.

Security privileges

Following

security privileges are created for the new functionality:

|

Security privilege

|

Description

|

Associated with

|

|

Setup

and get HMRC access tokens (TaxHMRCSetupMaintain_UK)

|

Edit Web service parameters,

Web applications (including Get test user, HMRC authorization, Get

access token, Refresh access token)

Access Level:

- TaxHMRCApplication_UK

{delete}

- TaxHMRCParameters_UK

{delete}

- TaxHMRCApplicationAuthorization_UK

{delete}

- TaxHMRCTestUserData_UK {delete}

- TaxHMRCHelper_UK

methods (getAccessToken) {invoke}

|

Duty: Maintain sales tax

transactions (TaxSalesTaxTransactionsMaintain)

|

|

Retrieve

HMRC VAT obligation (TaxHMRCVATObligationRetrieve_UK)

|

Retrieve VAT obligations on the

form VAT returns submission

Access Level:

- TaxHMRCApplication_UK

{read}

- TaxHMRCVATObligation_UK

{correct}

- TaxHMRCHelper_UK

methods (retrieveVATObligations) {invoke}

|

Duty:

Maintain sales tax transactions (TaxSalesTaxTransactionsMaintain)

|

|

Generate

HMRC VAT return (TaxHMRCVATObligationGenerate_UK)

|

Generate VAT return on the form VAT

returns submission

Access Level:

- TaxHMRCVATObligation_UK

{correct}

- TaxHMRCHelper_UK

methods (generateVATReturn) {invoke}

|

Duty: Maintain sales tax

transactions (TaxSalesTaxTransactionsMaintain)

|

|

Submit

HMRC VAT return (TaxHMRCVATObligationSubmit_UK)

|

Submit VAT return on the form VAT

returns submission

Access Level:

- TaxHMRCApplication_UK

{read}

- TaxHMRCVATObligation_UK

{correct}

- TaxHMRCHelper_UK

methods (submitVATReturn) {invoke}

|

Duty:

Maintain sales tax transactions (TaxSalesTaxTransactionsMaintain)

|

|

View

HMRC VAT obligation (TaxHMRCVATObligationView_UK)

|

View VAT returns submission form.

Access Level:

- TaxHMRCVATObligation_UK

{read}

|

Duty: Inquire into sales tax

transaction status (TaxSalesTaxTransactionStatusInquire)

|

To review

or change distribution of security privileges by security duties and roles,

open System administration > Setup > Security > Security roles.