All the information that is provided through SPED-Reinf about taxes and contributions in a given assessment period is called a "movement." Therefore, each movement can contain one or more events.

To close the transmission of periodic events for a given movement in a given assessment period, you must send event R-2099, "Closure of periodic event." After the closure event has been processed and validated, is must be accepted. Acceptance of the closure event finalizes the sum of the calculation bases that are included in the movement. The tax credit can then be calculated, and the Federal Revenue Collection Document (Documento de Arrecadaçäo de Receitas Federais, DARF) can be generated for the collection of taxes and contributions that are owed.

Whenever a rectification or new events must be sent for a movement that has already been closed, the movement must be reopened by sending event R-2098, “Reopening of periodic event.” After a movement is successfully reopened, you must send a new closing event.

When there is no movement within the assessment period

The “no movement” situation for the taxpayer will occur only when there is no information to send to the periodic event group from event R-2010 to event R-2070. In this case, event R-2099, "Closure of periodic events," which provides the information for closure declares the non-occurrence of transactions in the first assessment period of the year when this situation occurs. If the "no movement" situation persists in the following years, the taxpayer must repeat this procedure in January of each year.

Receiving protocol

The receiving protocol confirms that the information that was sent was successfully delivered and validated to SPED-Reinf. The receiving protocol is the starting point for rectifying or deleting a given event, when rectification and deletion are allowed.

Every event that is transmitted has a receiving protocol. When you intend to rectify a given event, you must enter the number of the receiving protocol of that.

The amount of time that receiving protocols are kept in the government database isn’t defined. However as a precaution, it’s important that the taxpayer retain them, because they provide proof that the ancillary tax obligation was delivered and accomplished.

Note: The delivery protocol is transient information that provides proof that the event has been transmitted, and that the appropriate validation will be processed. The delivery protocol doesn’t demonstrate compliance with the ancillary obligation.

Amendment and rectification

The procedure for amending information that was sent to SPED-Reinf occurs only in events R-1000, ”Taxpayer information table,” and R-1070, “Administrative and lawsuits table.”

In all other cases where the information that was sent must be amended, the procedure for rectification or deletion must be used.

Deletion events

To exclude events that were approved by tax authority but delivered incorrectly, you must send event, R-9000, “Deletion event.” You must identify the event to exclude by filling in the Event Type tags (TpEvento). Additionally, in the Event Receipt Number (NRRECEVT) field, you must specify the receipt protocol number of the file that was sent and that must be deleted.

Digital signature

The digital certificate that is used in the SPED-Reinf must be issued by a certification authority that is accredited by the Brazilian Public Key Infrastructure (ICP-Brasil).

The digital certificate must belong to the “A” series. Certificates can belong to two series, “A” and “S.” The “A” series groups the digital signature certificates that are used for web identity confirmation on emails, virtual private networks (VPNs), and electronic documents with verification of the integrity of its information. The “S” series groups the confidentiality certificates that are used to encode documents, databases, messages, and other sensitive electronic information.

The digital certificate must be of type “A1” or “A3.” Digital certificates of the “A1” type are stored on the computer where they are used. Digital certificates of the “A3” type are stored in a tamper-resistant portable device, such as a smart card or token, that contains a chip that can perform the digital signature. This type of device is reasonably secure, because every operation is performed by the chip on the device, and there is no external access to the private key of the digital certificate.

The digital certificates are required in two different moments:

- For delivery: Before the request for delivery to SPED-Reinf is started, the requestor’s digital certificate is used to help guarantee the safety of the information traffic on the internet. For the digital certificate to be accepted as a transmitter function, it must be of the e-CNPJ type.

- For document signing: The events can be generated by any fiscal establishment of the legal entity, or by its proxy. However, their digital subscriber must belong to the main fiscal establishment (headquarter) or its legal representative, or an attorney that is granted by means of electronic and non-electronic proxies.

The digital certificates that are used to sign the events that are sent to SPED-Reinf must be enabled for the digital signature function with respect to the certificate policy.

The events in the SPED-Reinf must be transmitted by using a valid digital certificate. However, an exception is made for micro and small businesses (ME and EPP) that fit into the Simple Nacional criteria and that have up to seven employees. These businesses can transmit their events via access code.

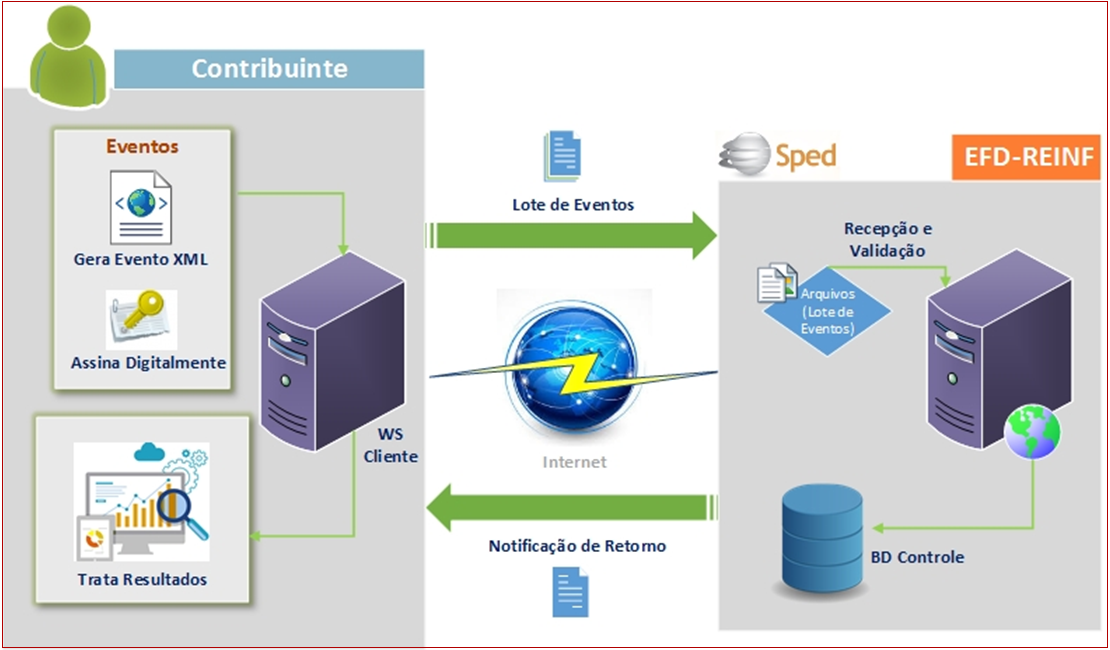

Work flow

- Use reporting services to create the related events. Schema validation is run before delivery.

- Deliver the event or batch of events through reporting services.

- The Web service (WS) tax authority receives the batch and validates its contents.

- The WS tax authority returns the results of processing. If the events were successfully received, a receiving protocol is returned. Otherwise, an error message is returned. In this case, the taxpayer can address the errors and resubmit the event through a new batch.

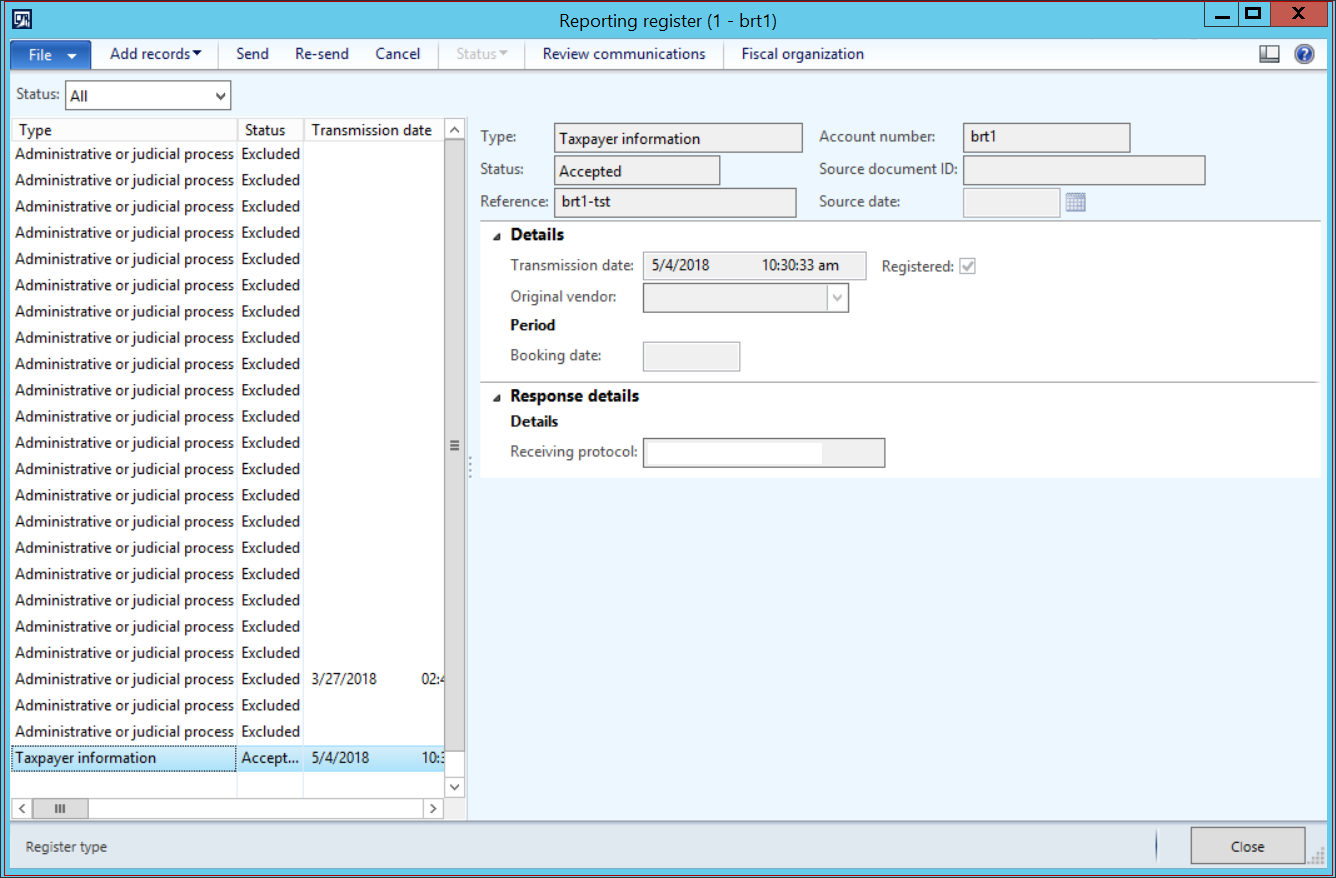

Reporting register

The events that are transmitted to tax authorities are based on the system for the Immediate Provision of Information (Sistema de Suministro Inmediato de Información, SII). SSI enables a two-way, automated, and instantaneous relationship between the government web services and the taxpayer.

All events are managed and controlled at Fiscal books > Periodic > SPED Reinf > Reporting Register.

Fields descriptions

|

Field name

|

Field description

|

|

Type

|

The type of event to include. The value of this field is automatically used as the event type for new records that you add by clicking Add records. The following types of records are used to transmit SPED Reinf events:

- Administrative and Judicial process (R-1070)

- Acquired services events (R-2010)

- INSS-CPRB assessment (R-2060)

- Provided services events (R-2020)

- Taxpayer information (R-1010)

- Closing event (R-2099)

|

|

Status

|

The current status of the event. This value of this field is automatically entered and updated, based on the exchange of messages between the tax authority and the taxpayer. The following statuses are used:

- Created – The event was added to the register, but it hasn’t been sent to the web service yet.

- Rejected – The event was sent to the web service, but it was rejected by the tax authority system. A specific tag group in the XML file that is returned by the government is used to specify the error code and description.

- Accepted – The event was sent to the web service, and it was accepted by the tax authority system.

- Accepted with errors – The event was sent to the web service, and it was accepted by the tax authority system even though it has errors.

|

|

Reference

|

The unique identifier of an event. The value of this field is automatically generated, based on the type of event.

- Administrative and Judicial process (R-1070) = Process number

- Acquired services events (R-2010) = Fiscal establishment ID – event number

- INSS-CPRB assessment (R-2060) = Fiscal establishment ID – event number

- Provided services events (R-2020) = Fiscal establishment ID – event number

- Taxpayer information (R-1010) = Company ID - Fiscal establishment ID

- Closing event (R-2099) = Fiscal establishment ID – event number

|

|

Account number

|

The account number of a customer or vendor that corresponds to the Type value for events R-2010 and R-2020. The value of this field is automatically generated, based on the type of event.

|

|

Source document ID

|

Related document ID |

|

Source document date

|

Related document date |

|

Details FastTab

|

|

Transmission date

|

The date and time of the last status change for the event.

|

|

Registered

|

A selected check box indicates that the event was already registered in the tax authority system.

|

|

Booking date

|

Booking period date |

|

Response details FastTab

|

|

Receiving protocol

|

The protocol number that was generated by the tax authority when the event was received. The value of this field is automatically updated when the status of the event is Accepted.

|

Function descriptions

Add records

Use this function to automatically update the Reporting registers entries by adding a new event in it. In the Reporting register form, on the Action Pane, click Add records. To customize the events that should be added to the register, click Select.

Send

Use Send function when you want to create and send an XML report to the SII system. In the SII register form, on the Action Pane, click Send. To set up a query that the XML report should be based on, click Select. For example, if you want to send specific vendor or customer transactions for event R-2010 or R-2020, you can add a line to the Range grid, select Reference in the Field column, and select a specific invoice reference in the Criteria column.

When you click OK in the dialog box, Microsoft Dynamics AX generates the XML report, based on the criteria that you set up, and sends it to the tax authority system. After a short time, Microsoft Dynamics AX will receive the response from the tax authority system and automatically interpret it.

You can set up the reporting register to work in a batch regime. Enable the Batch option in the form.

Re-send

Events that have a status of Accepted or Accepted with errors can be re-sent to the tax authority system. In the SII register form, on the Action Pane, click Re-send.

Status

Events that have a status of Created or Rejected can be changed to Excluded status to optimize queries and work with the Reporting register. In the Reporting register form, on the Action Pane, click Status > Excluded. Events that have a status of Excluded can be manually changed to Created status by clicking Status > Created.

Cancel

Events that have a Status of Accepted or Accepted with errors can be canceled or excluded. After you receive confirmation from the tax authority system that the exclude operation was successfully canceled, you can change the status to Create and send the events again.

Review communications

All exchange XML messages that are issued and received are saved in Microsoft Dynamics. You can review the selected event that was issued (request) and received (response) by clicking

|

Left pane

|

|

Status

|

The status of each communication with the tax authority:

- None – No XML was transmitted because of technical issues in the tax authority environment.

- Sent – XML was delivered, but no response was received.

- Received – An XML event was received.

|

|

Schema validation

|

The status of schema validation:

- Success – All data and rules were successfully validated.

- Error – Errors occurred during data or rule validations.

|

|

Created date and time

|

The date and time when the event was created.

|

|

Modified date and time

|

The date and time of the response that was received from the tax authorities.

|

|

Right pane

|

|

Request

|

The XML file that was delivered to the tax authority system.

|

|

Response

|

The XML file that was received from the tax authority system.

|