Setup

To setup Quarterly VAT payment communication, the following steps should be done:

- Import GER configuration for Quarterly VAT payment communication in GER.

- Derive Quarterly VAT Communication format.

- Update derived Quarterly VAT Communication format.

- Add GER number sequence.

- Update input parameters.

- Complete derived Quarterly VAT Communication format.

- Setup General ledger parameters.

Import GER configuration for Quarterly VAT payment communication in GER

Import new configuration with name Quarterly VAT communication for Quarterly VAT payment communication report in GER from repository or directly from the LCS. From LCS you should import both updated Data Model Italian tax reports model version 2 and Format Quarterly VAT Communication based on this Data Model.

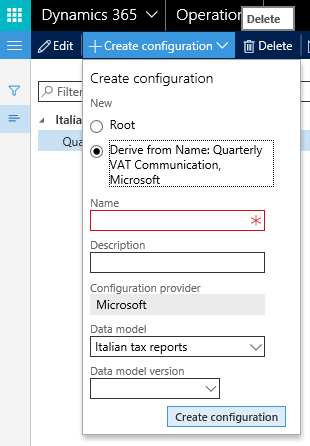

Derive Quarterly VAT Communication format

Open Workspaces > Electronic reporting and select Italian tax report model > Quarterly VAT Communication. Select Create configuration > Derive from name: Quarterly VAT Communication, enter Name and Description for new format and click Create configuration button.

The new format you’ve created includes all the fields and mapping form the original one. You can do all changes according to your company’s needs in the created format.

Update derived Quarterly VAT Communication format

Initially Quarterly VAT Communication format includes all the tags and mapping in accordance with officially published XSD schema on April 12th 2107.

You may need to update your format to adopt it to company’s needs or new legal requirements. To do so select a format that you derived from the Quarterly VAT Communication format and click Designer on the Main menu.

Format designer window is divided into two parts: the left side – is a format structure (it is an XML scheme); the right side – is a Data Model (data). Press Mapping button in the right side to see the Data model.

For more information about ER, see the following topics:

Electronic reporting overview

Download Electronic reporting configurations from Lifecycle Services

Localization requirements – Create a GER configuration

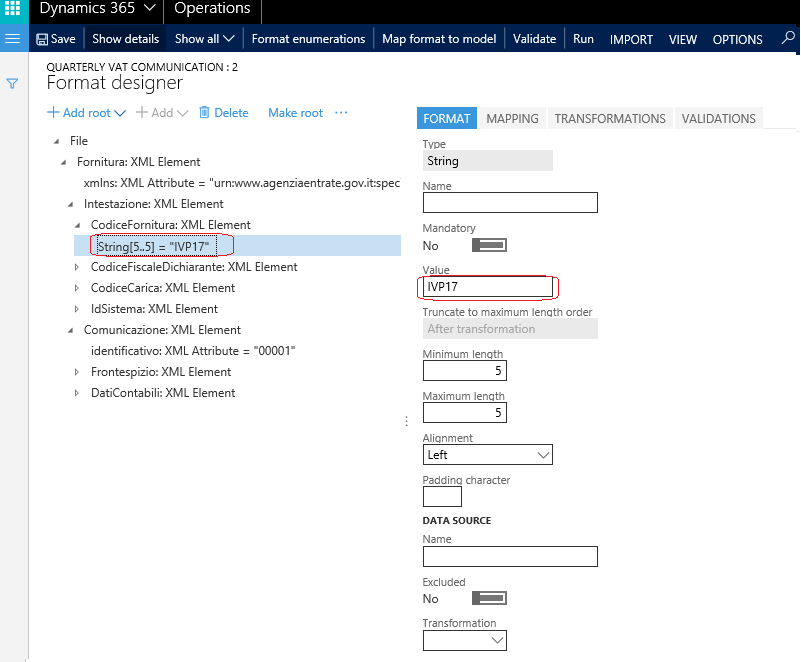

To review or update the schema, roll out the tree structure on left side.

To update tags with new default values or change other parameters, select the tag on the left side and open FORMAT tab on the right side:

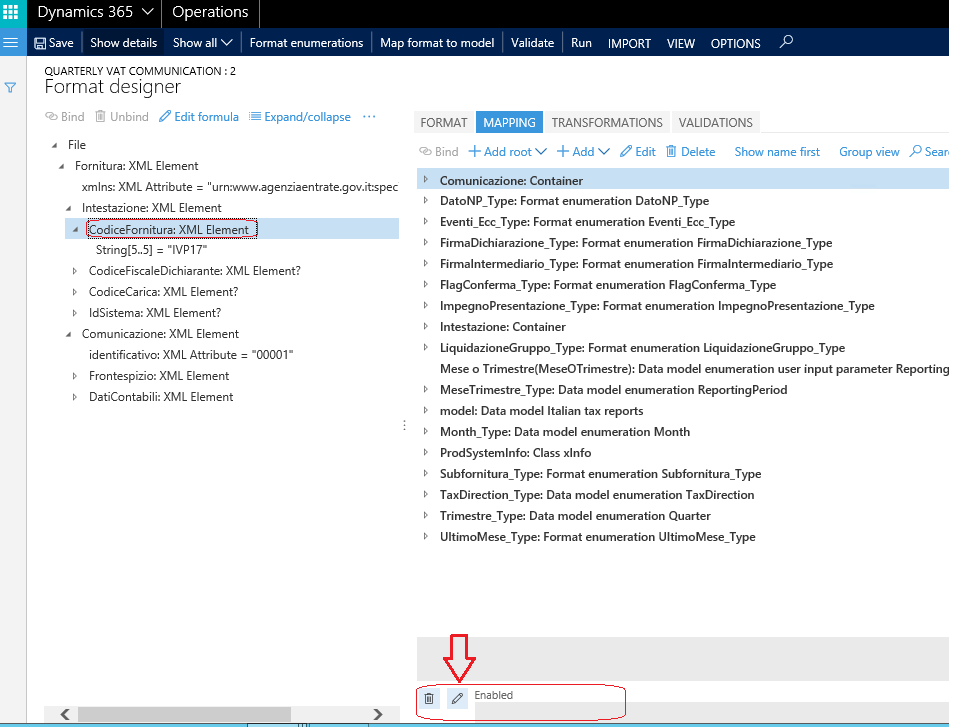

If some tag is not applicable for you company, you may delete it in the format structure tree or set up enabled formula on MAPPING tab:

When you open Formula designer you can set up “False” in the FORMULA window to disable a tag or set up a specific formula to set up a condition under which a tag should be disabled or enabled. (More information about Format designer - Formula designer in Electronic reporting).

Note, if you delete a tag, the value for which should be entered manually through the configuration dialog you will need to delete the related input parameter ether.

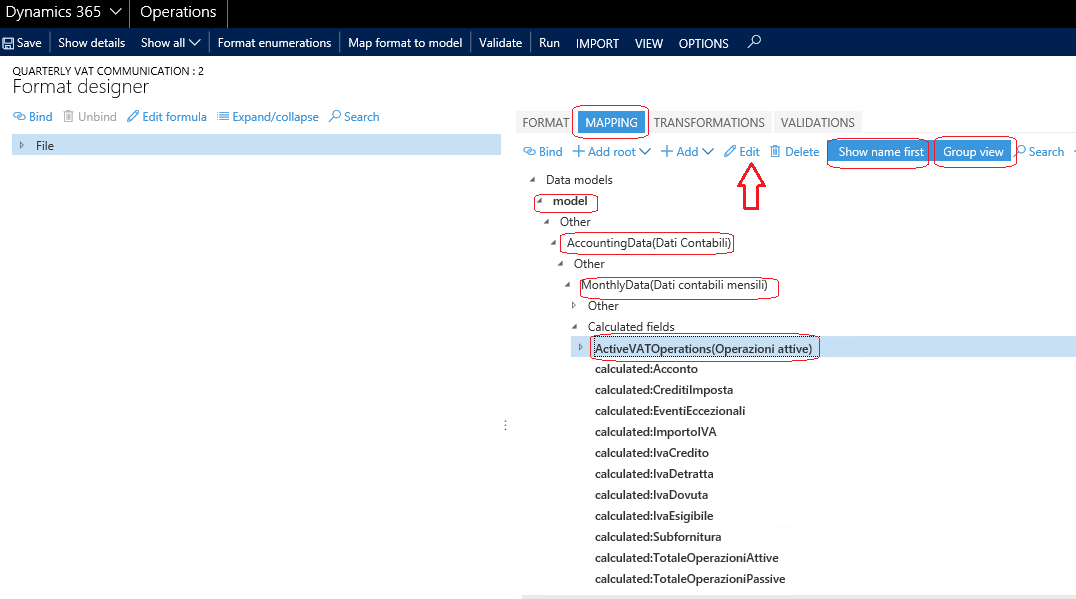

Values for tags TotaleOperazioniAttive, TotaleOperazioniPassive, IvaEsigibile, IvaDetratta should be collected from the Tax Transactions in the data base taking into account particular Tax codes used by your company and Tax directions applicable to your company. To do so, open MAPPING tab and find Model > AccountingData > MonthlyData > ActiveVATOperations node and click Edit.

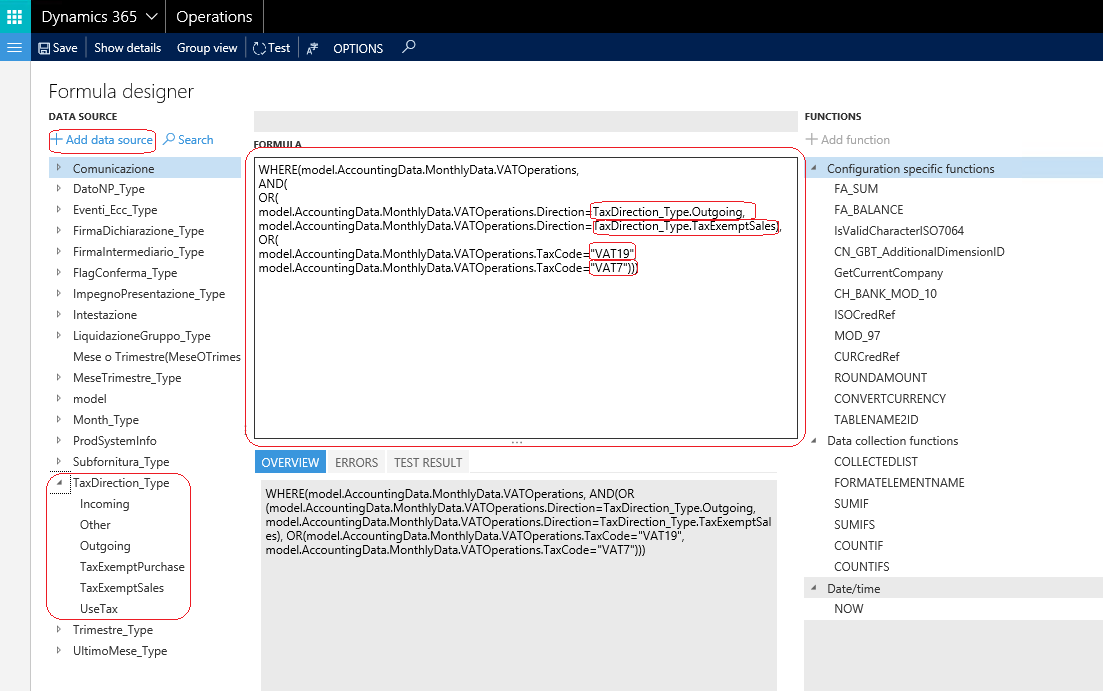

Update formula with Tax codes with values used by your company and Tax direction applicable for your company. You should select values for Tax direction from the Data Source TaxDirection_Type on the left:

Tax transactions selected by this query will be taken into account to calculate values for TotaleOperazioniAttive, IvaEsigibile tags.

To select tax transactions that should be taken into account to calculate TotaleOperazioniPassive, IvaDetratta tags open Model > AccountingData > MonthlyData > PassiveVATOperations node and click Edit. Update formula for this node similarly with Tax codes with values used by your company and Tax directions applicable for your company.

Add GER number sequence

According to requirements the name of the file should include a unique sequential number in format #####.

Initial configuration includes default value “00000” for the file name. You need to do an additional setup to let system automatically numerate your files.

Create new AX number sequence. It is preferable to set up a number sequence length to 5 and format to ##### as this number sequence will be used as part of the file name.

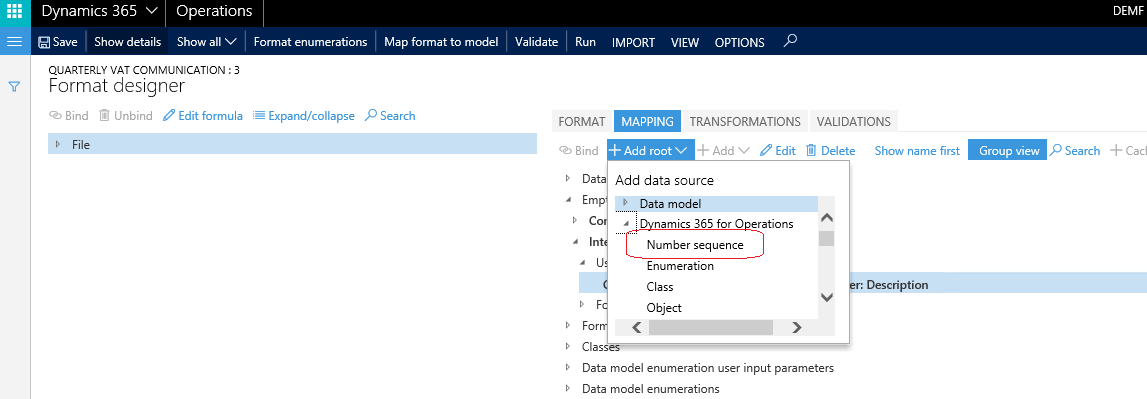

Open GER and select format Quarterly VAT communication format created for your company and click Designer, select MAPPING tab and click Add root > Dynamics 365 for Operations > Number sequence:

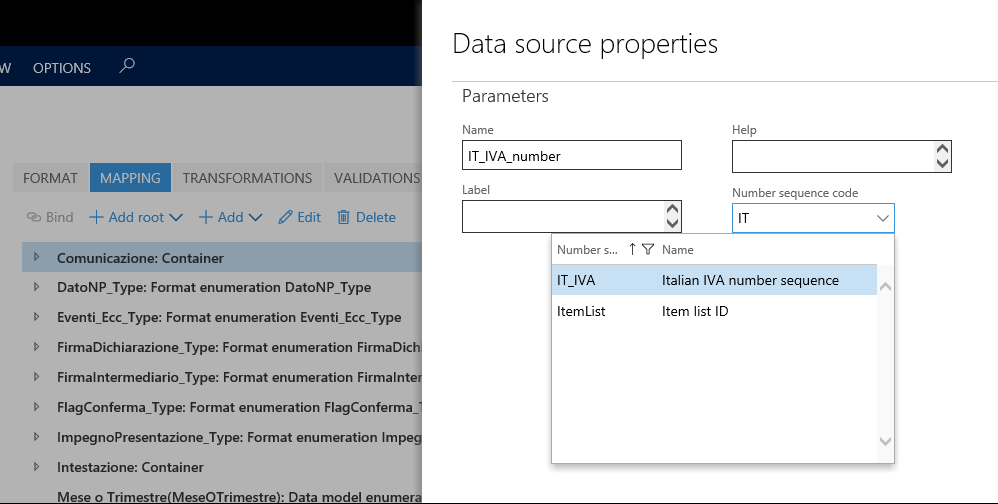

In the opened window enter Name, Description and select created number sequence:

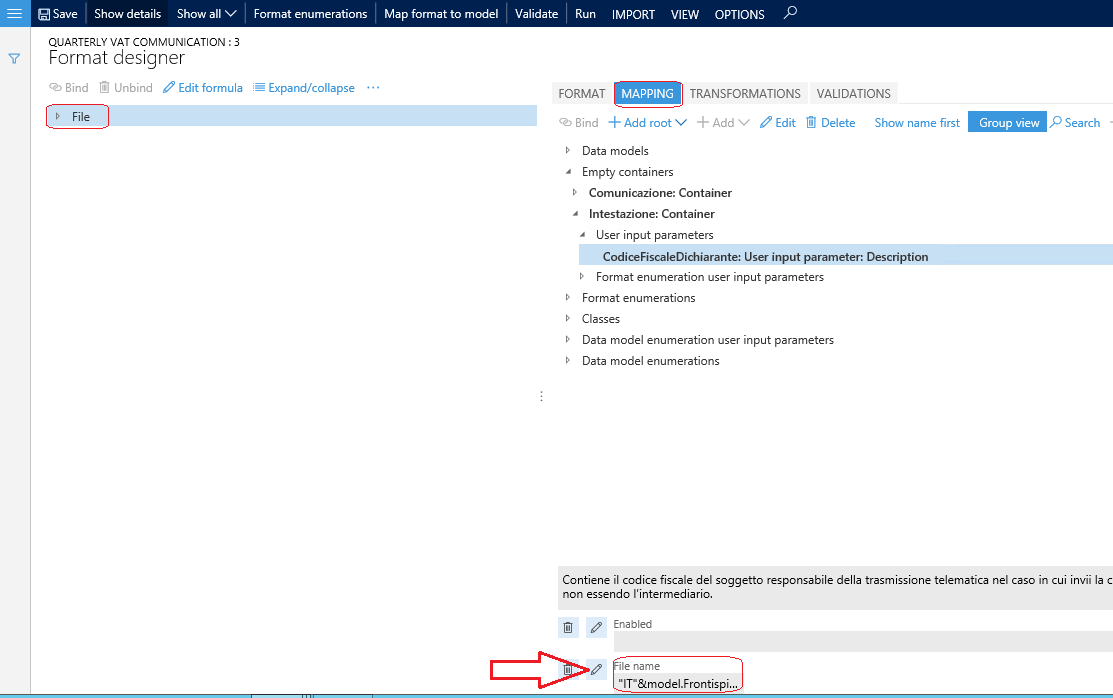

Update a formula for the file name. To do so, select File in the format structure tree and edit formula for the file name:

Update ["IT"&model.Frontispiece.FiscalCode&"_LI_00000"] with formula that includes a link to new Number sequence: ["IT"&model.Frontispiece.FiscalCode&"_LI_"&IT_IVA_number] where IT_IVA_number is the name that you gave to the Number sequence.

Update input parameters

Some of the format tags values can be filled in manually only. To do so, the corresponding tags are included in the report dialogue.

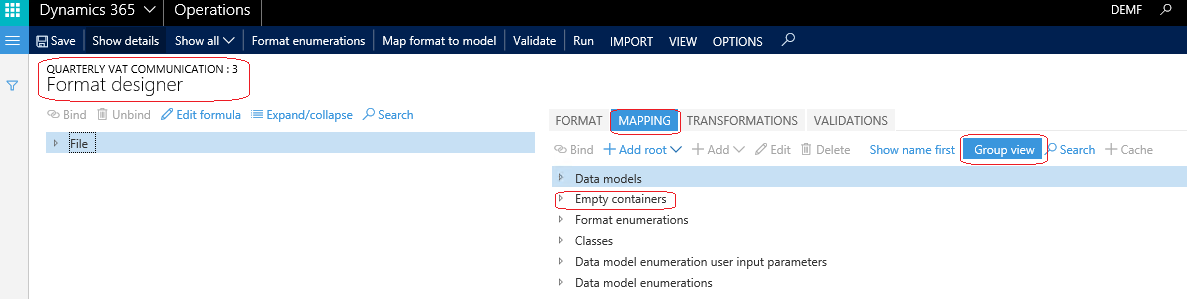

To add, delete or update included in the report dialog fields open format created for you company in Designer, open MAPPING tab and switch to Group view and find Empty containers node.

This node includes all the input parameters of the report grouped by blocks of the XSD schema.

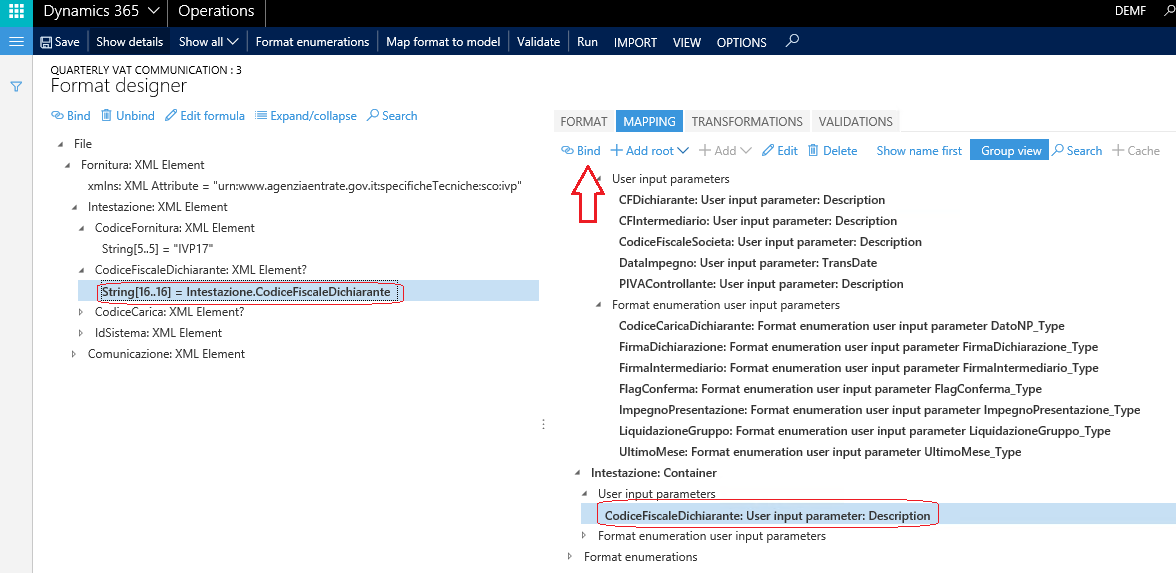

Note, if an input parameter was deleted corresponding field will lose its data source that is why you need to delete or update mapping for the corresponding field as well. To do so, roll out the format structure tree, find corresponding field and delete or update its mapping.

If you need to add additional input parameter, add it in the corresponding node in Empty containers, add a tag in format structure tree and Bind them.

Complete derived Quarterly VAT Communication format

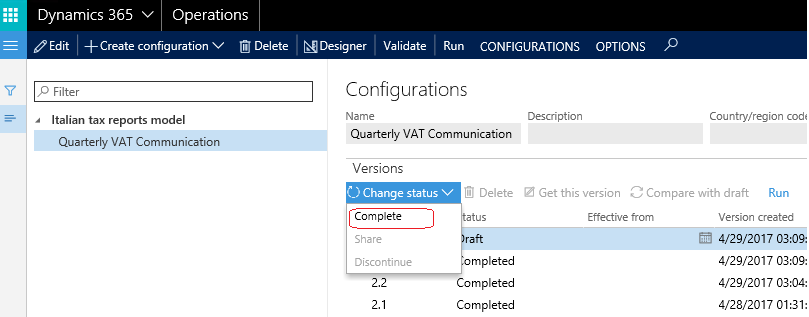

When you have finished format updating, save the format, close it and complete the format using Change status > Complete button on the versions menu on Versions fasttab on Configurations.

Setup General ledger parameters

New menu item for Quarterly VAT payment communication report should be associated with created and updated format for your company. To do so, open Tax > Setup > Sales tax > General ledger parameters and select tab Sales tax. Open Quarterly VAT communication fasttab and select GER format that you created and completed for your company in Format mapping field.

Generate Quarterly VAT payment communication

To generate an XML file for a Quarterly VAT payment communication, select a report in the Tax > Declarations > Sales tax > Quarterly VAT communication.

In the dialog form enter values for tags that a set up for your company.

Field name | Description |

Anno | Enter year for which you are going to generate a report |

Periodo di liquidazione | Enter a settlement period that will be used to identify correct data for tags DebitoPrecedente, CreditoPeriodoPrecedente, CreditoAnnoPrecedente. |

Trimestre | Select a quarter for which you are going to generate a report. |

Mese o Trimestre | Select one of two values: - Quarter – if you want to generate an XML file with one Modulo block related to the selected quarter.

- Month – if you want to generate an XML file with three Modulo blocks related to three months of the selected quarter.

|

CodiceFiscaleDichiarante | Enter fiscal code of a Dichiarante or leave it empty if it is not applicable for your company. If it is not empty you should fill the tag CodiceCarica. |

CodiceCarica | If CodiceFiscaleDichiarante tag is not empty, fill in the tag CodiceCarica with corresponding value. |

PIVAControllante | Leave empty if it is not applicable for your company or enter Vat Registration number of the company/authority that is making controls in the case of group payment/settlement (law reference: last clause of art. 73) |

UltimoMese | Leave empty if it is not applicable for your company or enter last month of control in the case of group payment interruption (law reference: last clause of art. 73) |

LiquidazioneGruppo | Leave empty if it is not applicable for your company or if the communication deals with a group payment interruption enter a corresponding value (law reference: last clause of art. 73) |

CFDichiarante | Leave empty if it is not applicable for your company or enter fiscal code of the declaring natural that undertakes the communication |

CodiceCaricaDichiarante | Leave empty if it is not applicable for your company or enter corresponding value of the declaring subject |

CodiceFiscaleSocieta | Leave empty if it is not applicable for your company or enter the TAX code of the declarant company. Usually is the same of the VAT number, but in some cases, it could be different. |

FirmaDichiarazione | Select corresponding value from the list. |

CFIntermediario | Leave empty if it is not applicable for your company or enter a fiscal code of the intermediary in charge of the transmission. If you fill in this tag you should fill in DataImpegno and FirmaIntermediario as well. |

ImpegnoPresentazione | Select corresponding value from the list: - 1 if the communication is prepared by the contributor,

- 2 if prepared by who is the sender,

- Not applicable

|

DataImpegno | If CFIntermediario is not empty fill in corresponding date in the format: ddMMyyyy. |

FirmaIntermediario | If CFIntermediario is not empty fill in an indicator of presence of the intermediary signature. |

FlagConferma | Select corresponding value from the list. |

Subfornitura, EventiEccezionali, VersamentiAutoUE, CreditiImposta, InteressiDovuti, Acconto | If in “Mese o Trimestre” you selected Month regime of file generation – fill in corresponding values for Mese1, Mese2, Mese3, where Mese1, Mese2, Mese3 are months of the selected quarter. If in “Mese o Trimestre” you selected Quarter regime of file generation – fill in corresponding values for Trimestre where Trimestre is a selected quarter. |

Click OK button on the form to generate report.